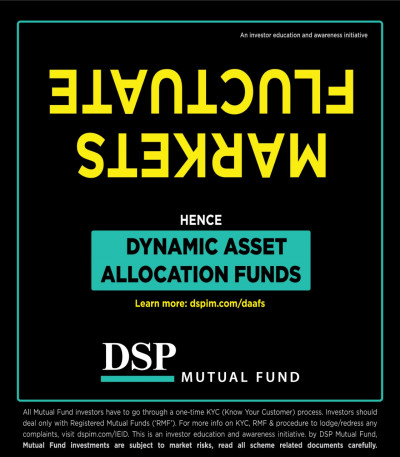

DSP Mutual Fund unveils outdoor campaign to build category awareness

DSP Mutual Fund unveiled a quirky outdoor campaign to build awareness and education on the ‘Dynamic Asset Allocation Funds’ category. The campaign uses a bold new creative with an upside down headline to drive home the market reality: ups, downs and fluctuations are a way of life at the stock market. Given these fluctuations won’t go away, it is a good idea for investors to adjust one’s perspective and stay balanced to deal with volatility.

Volatility can cause confusion in the minds of investors. Questions like where to invest, how much to invest, when to buy or sell, how to invest in equity & debt in a rational manner, come in the way of their decision making. This becomes especially relevant given the last couple of years – when ups and downs in the market have been bothering investors.

This is where Dynamic Asset Allocation Funds come in. DAAFs help reduce the stress that market volatility and the above questions cause in investors’ minds and help them invest in peace. They dynamically adjust the allocation to different asset classes based on a pre-set model by considering market conditions and filters that determine the optimum allocation with the objective of generating long-term appreciation. This is a suitable category of funds for those who aim to be in the right asset class at the right valuations and at the right time.

DSP Mutual Fund has rolled out the outdoor campaign across almost 70 cities/towns across India.

Aditi Kothari Desai, Director & Head - Sales and Marketing, DSP Investment Managers said, “Our endeavour to create stand-out marketing pieces continues with this outdoor awareness campaign, following on to our Dancing Uncle DAAFs video campaign, that went viral earlier. The idea behind this campaign is to grab attention and build awareness about this product category while contextualising it to the truth behind the markets in a simple, memorable, visual manner. We genuinely believe DAAFs are a worthy addition to investors’ portfolios and our advisors’ recommendation lists at all times - given that markets always operate in cycles: with constant ups/downs/fluctuations. We’re expecting that this creative and media strategy will give rise to curiosity and conversations on DAAFs.”

Atul Bhole, Fund Manager- Equities, DSP Investment Managers said, “Investors wanting to invest in markets through mutual funds for the first time tend to have fairly low risk appetite - they get stressed with short term fluctuations in their portfolios. For such investors, DAAFs could be a worthy addition to their portfolio. They help in providing the benefit of market upsides while also seeking to limit the downside risk as and when the markets move up or down. DAAFs can also help experienced investors who are worried about volatility and therefore can form a core part of their portfolio.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn