Eyeballs haven’t dwindled because we have instituted new tariffs: Sudhanshu Vats

The Telecom Regulatory Authority of India (TRAI) had recently mandated a new tariff regime that is to come into effect from December 29, 2018. The TRAI tariff order is aimed at empowering the consumers to select channels of their choice and also aims at bringing in transparency across the entire broadcast ecosystem.

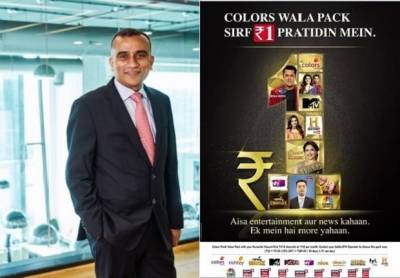

Complying with TRAI’s mandate, Viacom18 and TV18 have unveiled their new tariff rates ahead of the December 29 deadline. Their Value Pack, comprising the top channels across genres, is priced at just ₹1 per day.

Sudhanshu Vats, Group CEO & Managing Director, Viacom18, speaks to Adgully about the strategy behind the new tariff rates, impact on viewership, advertiser response and much more. Excerpts:

What is the strategy behind Viacom18 and TV18’s new tariff plans?

In the times that we live in, we often wonder what can a ₹1 coin buy us? Viacom18 and TV18 have joined hands to address this issue of price rise with the Value Pack, comprising the top channels across genres, at ₹1 per day. In a country where entertainment is the fourth basic need in addition to roti, kapda and makaan, Viacom18 and TV18 have the nation covered in that.

The first thing that comes out in our campaign and the tariff rates is that the consumer is at the center of it all. Somewhere in the back of our heads there was a feeling that the consumer was not getting his due. The second reason for the new regime is equity, transparency and objectivity. I am quite confident that after the initial period of settling down that will happen. The third thing that comes out in our campaign is to explicitly put across our offering. We have a comprehensive bouquet that caters to a wide range of demographics.

We have focused on our wide variety in the campaign. We have kept the terminology simple without any corporate jargons, calling it the ‘Colors wala plan’. While we have many brands, our most formidable one is Colors. The next thing is that our pricing is very attractive and so we brought in the concept of ₹1. Hence, we have used the creative hook of ₹1. The proposition is easy to remember and reminds the viewer of our value quite strongly.

Through the visual mnemonic and our audio-visual films we are bringing out the variety – in our entertainment and news offerings; the variety between different age groups; the variety between genres, where we represent all genres barring one.

Educating the consumer is going to be the most fundamental challenge. Up until now, it was assumed that the consumer knows and it was left to the last mile, but now we have to educate so that the consumer or household makes an informed choice.

Broadly speaking, we have got 10 packs in SD and HD. These 10 packs are largely language based. There are two values offered within the packs, one is Budget value and the other is Family. All our channels, as mandated by law, are also available a-la-carte. The a-la-carte pricing was already there and is available on our websites. The bouquets that we have designed are quite compelling and therefore, the consumer may not want to pick up one channel.

In the metros what if people drop the GECs and only take the English and Sports channels?

In the metros, we have seen a high consumption of GECs. Some people may choose to do this, but that would be a small proportion. However, a vast majority of India is bilingual and we communicate in more than one language. There might be a miniscule portion that knows just one language. Even in the big cities, the youngsters in the family might prefer watching English content, while their parents and grandparents might still watch in regional languages. That break-up will remain and I wouldn’t worry about it.

What will happen to the channels that are not in the top 10? Will the bouquet size shrink?

There will be different segments that will be catered to in a different form. We will be offering channels that are of interest to our consumers. Frankly, in media and entertainment the long tail is somewhat of a given. If you look at the genres, majority of the consumption in the country happens on GECs and movies. If you look at Hindi and regional languages, you will see that 80 per cent of the consumption happens there. So why should anybody watch anything else?

India being a vast country, there are certain segments like Kids and Infotainment that will always be watched. You cannot use one stick to measure it all, because it is viewership-led and moreover an ad-led industry. In a subscription model you can say watch whatever you want to.

Consumers seem to be clueless about the new tariff regime. What are you doing to make them aware?

We have launched a classic awareness campaign, where we will inform the consumers about what is available and at what price. The shift to the new tariff regime will take a few weeks. What will help the consumers decide in the end is the campaign and knowledge of the consumer.

What has the advertiser response been to the new tariff regime?

At a certain level they are indifferent, because their objective is to find out how many eyeballs are there and pay for those eyeballs. They are not bothered by how many eyeballs are reached and where they are reached, I don’t think they are too much worried about that.

If the Supreme Court order is upheld will prices come down?

If the Supreme Court order of 15 per cent is upheld, it will affect pricing. I don’t know whether the rates will come down, but the pricing will have to be reworked. If you look at it, the sum total of our channels and the discount that we are giving is lesser than 15 per cent. We have built in a lot of the current discounts that we have given.

There is an argument that if you take an aggregate of all the channels, then the pricing regime has made the channel prices go up. Is that true?

That may be true if you add up all the channels, but why would you? The whole point of the tariff regime is so that consumers can pick and choose the channels that they want to watch.

What would be the ARPU of broadcasters in the new tariff regime?

Let it settle down first. More than ARPUs, in my opinion the argument will be more about transparency. Hopefully it will do away with all under-reporting. If we can make this more transparent then I think it will become a more equitable value chain. That is the most welcome thing as far as broadcasters are concerned. The subsequent impact of that on subscription incomes is a fallout of that, but may not necessarily be driven by absolute ARPU increases.

Will the new pricing regime have a negligent impact on news channels, which are largely FTA?

There is a clear demarcation between pay channels and FTA channels as per the tariff order. You can only decide on how much you decide to price your channels at.

What is stopping the DPOs from making their own bouquet and selling to the consumers?

Theoretically they can do it, and some will. There may be a compelling reason for certain genres to be like that. But you must understand that if a DPO picks up my bouquet, he chooses to pay me for that bouquet. If he chooses to pick my channels a-la-carte to make a bouquet, he chooses to pay me at a-la-carte rates. That will be a question that they need to ask that will be determined by demand and supply.

What impact will this have on viewership numbers?

There will clearly be additional marketing expenditure to educate consumers on the changes and the new tariff order. In terms of revenue, if things settle fast then there will not be an impact on revenue, because all said and done India is watching TV. If you follow a conceptual premise that advertising follows eyeballs; well there are eyeballs. The eyeballs have not dwindled because we have instituted a new tariff order. They will continue to watch as per their habit. To reach out to those eyeballs, the advertisers will be ready to pay.

From an optimistic point of view, we do not expect a big impact on viewership as we are continuing with our programming and plan to launch new shows as well. Of course, there will be some pitfalls like on the subscription front there will be an arrangement between broadcasters and DPOs. Which means that approval will take a little longer, but that does not mean that the revenue isn’t there.

With the tariff order coming into force, do you believe the industry is moving towards a subscription-based model?

Our business has broadly two main sources of revenue – ad revenue and subscription revenue. In India, the subscription revenue stream was a little weaker compared to global benchmarks and over a period of time that will balance out, however, advertising remains extremely important for everyone. Advertising depends on the sophistication we are able to achieve in the kind of packaging and subscriber identification. Then in the longer term it is possible to look at possibilities.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn