Facebook joins the list of Payment Services with ‘Facebook Pay’

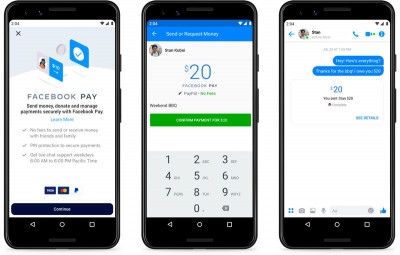

Facebook has entered the realm of payments services as the new competitor. On Tuesday (November 12, 2019), Facebook announced Facebook Pay, which will be an integrated payments solution for all Facebook-owned platforms, namely Whatsapp and Instagram. The payment method once added on one platform, will be synced across the others as well and the user doesn’t have to re-enter the payment information repeatedly. The company stated that Facebook Pay will offer users “a convenient, secure and consistent payment experience” across all its platforms.

The service will first roll out in the US this week and will support all major credit/ debit cards and PayPal. Facebook has stated that the payments will be processed in partnership with companies like PayPal and Stripe along with others around the world.

Furthermore, Facebook has made it clear that “Facebook Pay is separate from Calibra wallet, which will run on the Libra Network.”

In an official blogpost, Deborah Liu, VP, Marketplace & Commerce at Facebook, said, “People already use payments across our apps to shop, donate to causes and send money to each other. Facebook Pay will make these transactions easier while continuing to ensure your payment information is secure and protected.”

The service can be used to send money to friends, shopping and even donate to fundraisers. When it comes to security, Facebook claims to securely store and encrypt users’ cards and bank account details, perform anti-fraud monitoring for detection of unauthorised activity and also alert users with notifications about account activity.

However, this might be hard to believe for the user given the recent history of the company when it comes to security of information. Along with real time customer service via live chat, users can also access payment history, manage payment methods and update settings.

The talks of Whatsapp Pay had also surfaced in the market. It was going to be a UPI based payments service that would allow users to make payments via the instant messaging app. However, WhatsApp Pay has faced issues with getting the right approvals to launch in India. The Reserve Bank of India (RBI) wanted all the data from the service to be stored within the country. RBI said that WhatsApp Pay hasn’t complied with the data localisation norms yet. Only after an approval from the RBI and the National Payments Corporation of India (NPCI) can the service be launched in India. However, Mark Zuckerberg, CEO, Facebook, is confident that they will soon be able to share positive news on the launch of this service.

Meanwhile, Facebook Pay is focussing more on easing marketplace transactions on the platform. Deborah mentioned in the blogpost that “It is part of our ongoing work to make commerce more convenient, accessible and secure for people on our apps. And in doing so, we believe we can help businesses grow and empower people everywhere to buy and sell things online.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn