Footfalls in Dec 2021 major movie releases nearly back to pre-Covid levels: Emkay

After the Covid-induced disruptions, multiplexes came back strongly in December 2021, and they are expected to report a healthy performance in Q3 FY2022 despite a lower number of fully operational days with fresh content, predicts Emkay Global in its analysis of the M&E industry’s growth during the Covid period. Operating metrics such as ATP and SPH have seen an improvement compared with pre-Covid levels. In addition, both PVR and Inox are expected to generate positive cash-flows in Q3, which should keep the liquidity situation largely stable sequentially.

TV ad spending was robust during the festive season, while commodity cost inflation and weak demand after Diwali will likely to have restricted large advertisers’ ad spends. Domestic subscription revenue growth is also expected to be impacted by continued delays in the implementation of NTO 2.0.

Broadcasters

The operating performance of both Zee and Sun TV is not comparable with the year-ago period due to one-time syndication revenues in the case of the former and higher base of IPL revenues for the latter. Despite a seasonally strong quarter and the continuation of a gradual recovery, ad revenue growth is expected to be constrained by cost inflation for advertisers and weaker-than-estimated demand recovery after the festive period.

Emkay has pencilled in 8% yoy ad revenue growth for Zee and 20% for Sun TV, implying 2-year CAGRs of 7% and 4%, respectively. Domestic subscription revenues should continue to be impacted by the delay in the implementation of NTO 2.0. The increase in opex will be on account of higher content spends. Sun TV's amortization charge is also expected to rise in the quarter due to the release of own-production movie, ‘Annaatthe’.

Multiplexes

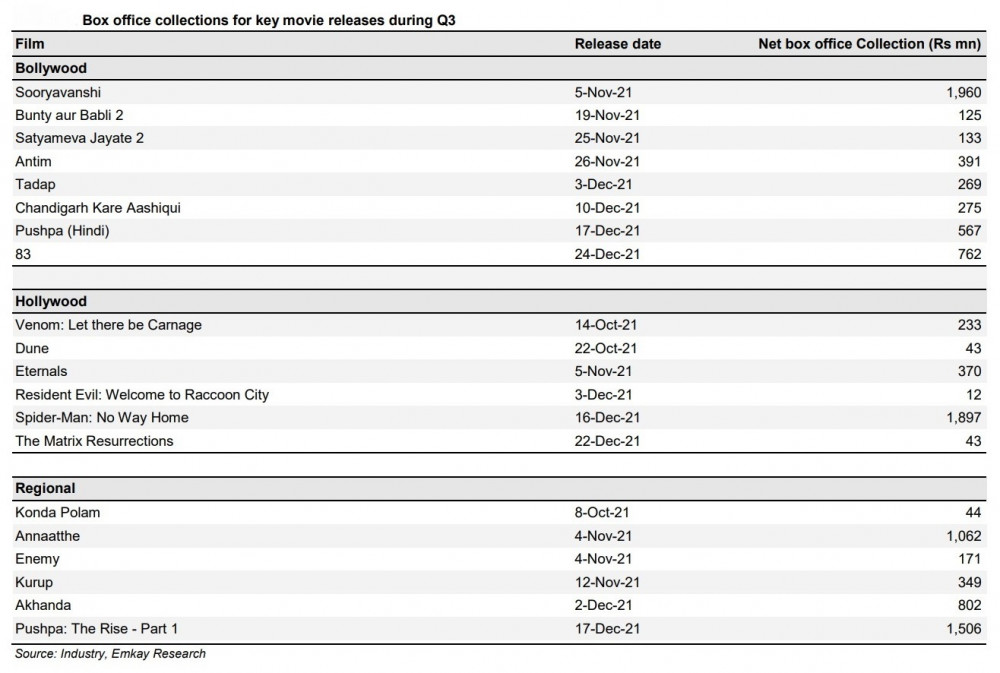

The footfall recovery has been satisfactory amid the 50% occupancy allowed by some state governments. Four movies garnered more than Rs 1 billion in NBOC. The initial estimates suggest that footfalls were nearly back to pre-Covid levels for the major movies released in December 2021. ATP growth of 3-4% CAGR on a 2-year basis for both PVR and Inox is mainly attributable to price increases and mix improvement in December due to the release of 3D movies. SPH has also improved at a healthy rate. The companies have resumed rent payments in Q3, though at discounted rates. This should partially benefit on the EBITDA front.

The quality of content has once again brought audiences back to cinemas, and this is structurally positive for the industry. Having said that, the recent resurgence in Covid cases and the reinforcement of state-wide lockdowns could make Q4 another lost quarter. However, we believe both companies have a strong liquidity position to overcome another painful quarter. We are hopeful that landlords and multiplexes will once again reach common grounds for discounted rent in 4Q.

Outlook

From a medium-term perspective, Emkay is positive on multiplexes, and the recent content performance has reinforced its faith in their business model. Both the companies’ healthy liquidity position and ability to gain incremental market share provide further confidence. Within the broadcasting space, Emkay prefers Zee, as it believes that the merger with Sony is a positive development for shareholders since it will resolve concerns around governance, board composition and funding for future expansion (using the cash pile at the merged entity).

The new entity will be the market leader in India, with a comprehensive bouquet of offerings, and will have the necessary B/S strength to invest in digital businesses and acquire sporting event rights. Emkay strongly believes that acquiring the rights to a major cricket event (IPL/ ICC India cricket series) will play a critical role in the significant facelift of the merged entity's OTT platforms. This could also lead to a valuation re-rating.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn