It’s the age of platform-first content strategy today: Girish Upadhyay, Axis My India

In this interview with Adgully, Girish Upadhyay, Chief Marketing Officer, Axis My India, delves into the key findings of the CSI report, exploring the trends in overall household spending, variations between rural and urban households, consumption patterns of health-related items, media consumption habits, and the preferences and subscriptions of OTT platforms.

Also Read: Axis My India and GetafixM Partner to build Consumer Insights Consulting

Also Read: Gen Z is watching IPL on JioCinema, says Axis My India survey

Additionally, Upadhyay also discusses the anticipated viewership patterns for the upcoming India vs Australia World Test Championship and the implications for platforms and broadcasters in catering to changing consumer preferences and retaining subscribers. Excerpts:

What are the key findings of the CSI report in terms of overall household spending? How does it differ between rural and urban households?

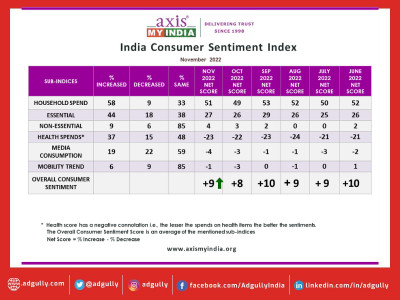

Overall Consumer Sentiment shows an upward swing in the last few months. Spends on essential items are back on track, but consumers are still holding on to discretionary spends. There is a cautious approach towards summer season categories, with a significant majority opting to delay their purchase. If we go deeper, we can see the affluent audiences have witnessed growth whereas the middle & lower income households are the ones who are cautious. A lot will be dependent on the monsoon season, and if that turns out to be normal, we should see this section of consumers bouncing back too.

According to the report, what are the trends in spending on essential and non-essential items? Is there any difference in spending patterns between rural and urban consumers?

Spends on essentials like personal care & household items have increased for 32% of the families, which is the same as last month. The net score, which was at +21 last month, is at +20 this month. Essential spending has increased more for the rural segment of the consumers (34%) as compared to Urban (29%). Spends on non-essential and discretionary products like AC, Car, and Refrigerator have increased for 5% of families, which is the same as last month. The net score, which was at +1 last month, is 0 this month. The slight rise in essential spends for rural consumers underscores the importance of meeting basic needs by the segment and the sustained demand for non-essential and discretionary products highlights the aspirational mindset of the 26-35 age group.

How has the consumption of health-related items changed, and what are the factors influencing this trend? Is there any variation in consumption based on income levels?

Post-Covid there is an overall consciousness towards health. Expenses towards health-related items such as vitamins, tests, and healthy food have surged, and this trend is true both among urban & rural consumers. Income is a driving force when it comes to showing greater concerns to health, caring about health, engaging in searching for health information, and valuing healthy conditions. But with improved literacy & access to knowledge there is a wider consciousness across the society which is good.

What are the notable trends in media consumption habits highlighted in the report? Which demographic groups showed the highest growth in media viewership?

The biggest trend in media consumption is that content is back to being the king. It’s the age of platform-first content strategy and your screen size determines the viewability of a particular content. You prefer to watch bite size content using Instagram Stories, Reels, YouTube Shorts on your mobile, general entertainment & reality shows on TV and magnum opus movies on cinema screens. The content consumption spectrum has increased, at one end viewers want to watch the best of global series on Netflix, and on another end Indian originals feature in the top 10 IMDb list. This diversity of content is resulting in increased viewership across demographic groups, but there is a higher skew in the younger 18-25YO.

Could you provide insights into the preferences and subscriptions of OTT platforms mentioned in the report? Which platforms are dominant, and what factors contribute to their popularity?

The rise of OTT and connected TV is another significant related trend. As consumers seek more personalised and engaging content experiences there is a greater need for platforms which can fulfil this need and which the OTT platforms are doing aptly. Our latest CSI report reveals that 37% have subscribed to some form of OTT, which is huge. Apart from Original series and movies, sports are a big content bucket in these OTT platforms. So, the dominant player might be JioCinema for the IPL, but viewers will shift to Disney+ Hotstar for the World Cup. The surrounding content which you build around this Hero content will define a platform’s loyalty and growth.

What are the anticipated viewership patterns for the upcoming India vs Australia World Test Championship? Are there any notable differences in interest between traditional TV viewing and digital/ mobile platforms?

When it comes to sports, there is a balanced interest in both traditional TV viewing and digital/ mobile platforms, as we witnessed during this year’s IPL and the World Test Championship. Both mediums have their advantages.

Traditional TV offers the benefit of enjoying sporting excitement on a large screen and the opportunity to watch it together with family and friends. On the other hand, digital/ mobile platforms provide ease of availability, flexibility to watch at a suitable time, and personalisation options. This highlights the significance of implementing multi-platform strategies for broadcasting major sporting events, in order to cater to the diverse preferences of consumers.

Based on the findings, what are the implications for platforms and broadcasters in terms of catering to changing consumer preferences and retaining subscribers?

As mentioned earlier, content preferences are changing at a rapid pace. The content that viewers like today might not be of interest to them tomorrow. Some of the factors which are influencing this phenomenon of evolving content preferences are: better connectivity, cheaper data plans, convenience, binge watching, more choices, localised content, personalised content, lesser ad breaks. Also, these preferences differ based on platform (such as paid TV, free TV, CTV and smartphone consumption), geographies, gender, etc.

In such a scenario, apart from having the right distribution and pricing strategy, the single-minded focus for platforms and broadcasters has to be to deliver high quality content. The way brands invest in measuring brand health, content creators need to invest in content preference studies, which helps them in understanding the content consumption habits of audiences in detail across varied traditional and new-media platforms. The challenge is not just to understand the current preferences but also gauge future preferences for delivering sharper and more relevant content which connects with the audience.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn