Media spends buoy India’s sports sponsorship to Rs 6,400cr:ESP Properties

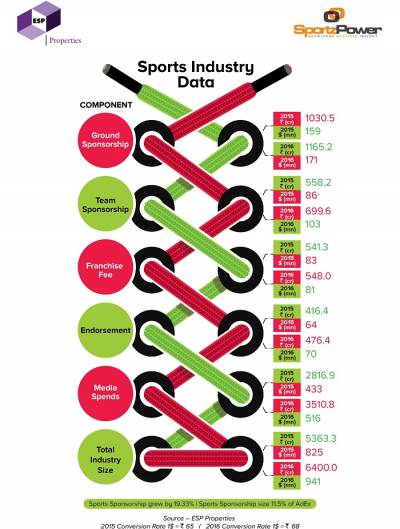

Sports sponsorship spending in India grew by 19.33 per cent in 2016 to Rs 6,400 crore as opposed to the preceding year (Rs 5,363.3 crore) and accounted for 11.5 per cent of the total Indian AdEx, according to ESP Properties’ study ‘Sporting Nation in the Making - IV’. ESP Properties, the sports and entertainment programming specialist arm of GroupM, and sports portal SportzPower. The biggest growth driver for sports sponsorship in 2016 was the media spends show – growing 24.63 per cent, it shot up from Rs 2,816.9 crore to Rs 3,510.8 crore. This was followed by ground sponsorship, which grew from Rs 1,030.5 crore to Rs 1,165.2 crore, a steady growth of 13 per cent in 2016.

The major insight of this report is that both Cricket and Non-Cricket held their own trajectory, and together pushed the industry forward. 2016 also seemed like a make-or-break year for some leagues, with some repositioning themselves to garner greater viewership, while others launching with a hungry audience base. Indian Cricket was on a high in 2016, both on the field and off it.

Vinit Karnik, Business Head, ESP Properties, believes that 2017 is definitely going to gain momentum in terms of the previous year’s high. According to him, “The report insights are the key to devising more refined viewer engagement. Gone are the days of male dominance in sports viewership. The year’s biggest chunk of spectators came from women and kids. This is ground-breaking data for brands to take that much desired leap of faith and traverse new grounds. Cricket continues to be the poster child for sponsorships, and non-Cricket sports still have a fair leap to make to match revenue. However, it is interesting to focus on the mushrooming of a very defined health and fitness consciousness within the country. Young digital India is breaking barriers and creating new records, especially when it comes to live feeds. Their smartphones are their all access pass to the ‘insider world’ of sports, sportsmen and their strengths and weaknesses. Sports start-ups are trending and the success achieved by league-based events across multiple sports indicates a strong potential to consume sports other than cricket.”

Thomas Abraham, Co-Founder, SportzPower, added here, “Viewership data demographics have been an eye-opener in 2016. Demonetisation disruptions aside, 2016 was a great year for the industry and this year will be even more so. Team sponsorships may have experienced certain upheavals and newer leagues will change the sporting diaspora even more so this year. However, what remains to be seen is franchise sustenance, endorsement rates and the manner in which technology and data influence these numbers. We expect 2017 to only get bigger, not just on the back of growth from the leagues that are now up and running, but also from new kids on the block that are debuting in the year – Table Tennis being a notable one.”

Thus, 2016 proved to be apocalyptic for some leagues that had risen out of the woodworks since 2011-12 and they finally culminated in imminent death.

Going forward, a lot is in store for sports in 2017. The first two months have already provided an indication to what promises to be an action packed year for Sportainment. Digital and offline are now two sides of the same coin. Looking forward, ESP Properties and SportzPower expect India’s sports market to grow at a faster pace vis-à-vis the last few years, aided by government policy and an increasing demand for recreational sports.

Key Observations

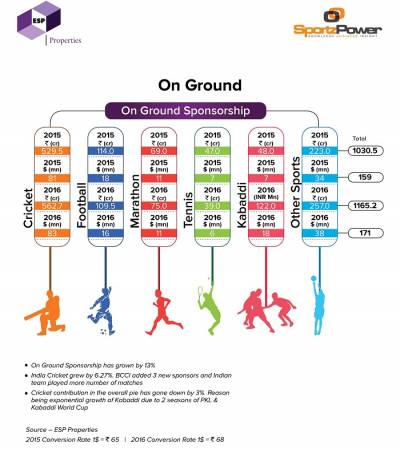

On Ground Sponsorships

- On Ground Sponsorship grew from Rs 1030.5 crore to Rs 1165.2 crore – a steady 13 per cent growth in 2016

- Kabaddi saw a momentous 154 per cent increase in On Ground sponsorship, thus accruing Rs 74 crore over and above earnings from the previous year due to Kabbadi World Cup and additional season of Pro Kabbadi League

- Cricket added Rs 33.2 crore over its numbers in the previous year. Three new associate sponsors – Pepsi, Hyundai and Jana Financial Services – together accounted for Rs 1.6 crore in additional revenue per match

- PWL took a hit allegedly due to demonetisation

- In Other Sports, HIL and PBL were the only two sports principally driving On Ground Sponsorships upwards by 15 per cent, thus taking the figures to a solid Rs 257 crore, from Rs 223 crore in 2015

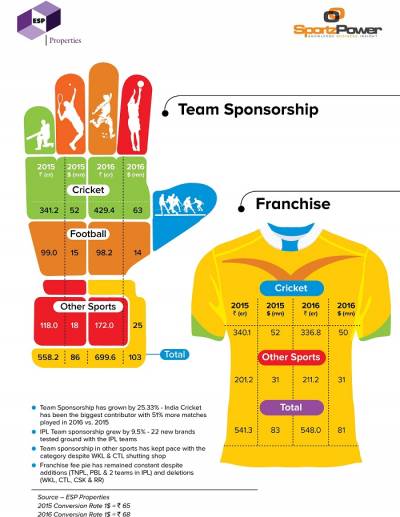

Team Sponsorships & Franchise Fee

- Overall team sponsorship grew by 25.33 per cent

- Cricket as a Sport sprung forward on team sponsorship as compared to the rest of the pack with 51 per cent more matches played in 2016 as opposed to 2015

- 22 new brands tested IPL waters in team sponsorship, causing it to tumult forward by 9.5 per cent in 2016

- Football, while trying to stay neck to neck with Cricket, instead witnessed a loss from Rs 99 crore in 2015 to Rs 98.2 crore in 2016

- Sponsors went down marginally for ISL as well with numbers dropping to Rs 37.2 crore as against Rs 38 crore in the year ago period

- Kabaddi saw a 45.76 per cent increase in its two-season swing – the highest by any sport

- Franchise fee pie has remained constant despite additions (TNPL, PBL and 2 teams in IPL) and deletions (WKL, CTL, CSK & RR)

- Highlight of the year was BCCI waiving off franchise fee commitments of suspended teams CSK and RR until their return to IPL in 2018

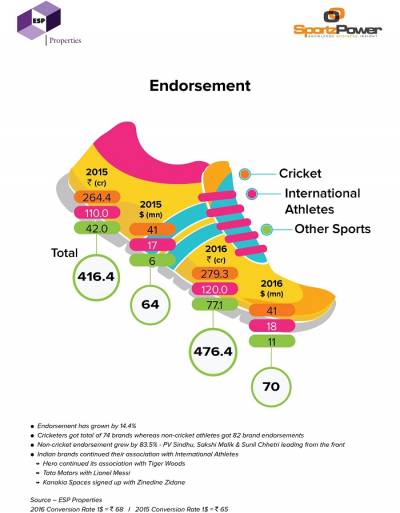

Endorsements

- Endorsements overall saw a growth of 14.4 per cent

- Cricket as a sport saw a commitment of 72 brands, whereas together non-cricket athletes secured 82 brand endorsements

- International athlete endorsements with Indian brands continued successfully in 2016 - Kanakia Spaces with Zinedine Zidane added to the list

- Rio Olympic medal winners PV Sindhu and Sakshi Malik contributed to Non-Cricket endorsements growing by 83.5 per cent in 2016, from Rs 42 crore to Rs 77.1 crore

- Virat Kohli emerged as King Midas of the cricketing arena and had the biggest part to play in Cricket endorsements rising from Rs 264.4 crore to Rs 279.3 crore in 2016

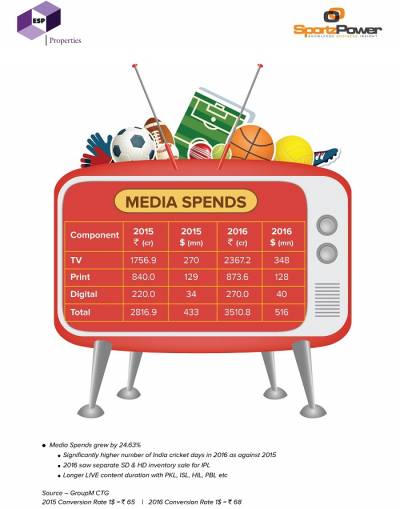

Media Spends

- Media spends being the biggest contributor grew handsomely by 24.63 per cent from Rs 2816.9 crore in 2015 to Rs 3510.8 crore in 2016

- On Air spending in Sport grew an incredible 34.74 per cent, from Rs 1756.9 crore to Rs 2367.2 crore

- Cricket was the golden egg laying duck with Rs 1,020 crore+ net in ad sales revenues for Sony Pictures Network India, a good 25+ per cent over 2015’s numbers

- For the first time, there were separate SD and HD sales for IPL in 2016

- Women (41 per cent, including rural) and kids dominated the viewership pie for IPL

- Multiple events of international stature such as ICC World Twenty20, the Kabaddi World Cup, and the Junior Hockey World Cup enabled broadcasters to pull in higher ad sale revenues

- Media spending increased proportionately to live content duration which essentially increased in 2016 for all sports

- The Rio Olympics live broadcast made technology history in 2016 – simulcast on all eight Star Sports channels (four in SD and four in HD), the network’s OTT platform Hotstar’s 14 live feeds and 36 concurrent feeds with over 3,000 hours of live coverage for a record 191 million viewers

Mobile & Social Media

- Cricket is on everybody’s mind and digital space with IPL dominating 79 per cent of social conversations and 84 per cent of searches

- In terms of numbers, IPTL audience is the most digitally active sports viewer and despite popularity, PKL has the least traction online

- Mumbai Indians & Kolkata Knight Riders are the only two sports franchises in India to have crossed the 10-million mark when it comes to Facebook followers

- Atletico de Kolkata is the only ISL franchise to have crossed the 1-million mark on Facebook

- Virat Kohli is Numero Uno when it comes to digital numbers

- While PV Sindhu is the belle of the ball when it comes to social conversations and search volumes; Sania Mirza is the reigning queen of Twitter and Facebook

Looking Ahead - Year 2017

- Digital and offline experience are now two sides of the same coin, however, there isn’t any picking in terms of heads or tails – game stats combined with video feeds need to seek out fans rather than fans seeking them out

- These very stats raised with data analytics can give athletes a deeper, more engaged insight into their strengths and weaknesses and enable them to stay ahead of the curve

- Data analytics is also influencing franchise owners, selectors and coaches to draw the best team combinations and to measure player’s on-field and of field value in a quantitative, objective manner thus working towards a more data-driven auction strategy and execution

- Virtual Reality can change the way fans experience sport making it more immersive even from a remote location and redefine community activated gaming a la Pokemon Go and maybe even sports itself

- 2017 will spawn even more new league debuts – with Table Tennis creating a lot of buzz

- October 2017 will be the first time India hosts a FIFA tournament and that’s huge not only in terms of events but also developing international standards of the six hosting venues

- A Digital Renaissance in the sporting realm is on the anvil this year with increasing participation from corporate houses and schemes introduced by the government – all efforts focused on the “consumer”

- The “Live” funda will remain central in the broadcast format despite evolving to newer, multiple platforms

- 2017 will be the threshold year for More Gaming!

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn