Music, video and media apps drive most ad impressions in India

Opera Mediaworks today launched its quarterly Mobile First Insights (MFI) report for India. It is designed to help marketers navigate the quickly changing mobile environment and make strategic decisions that will drive real outcomes for their business.

Entertainment driving mobile ad impressions in India

Despite what we hear about the ongoing adoption of social media and messaging apps, and the emergence of m-commerce, the primary driver of this time spent is not either of these categories. Music, Video & Media was the top category for impressions served on Opera’s mobile-ad platform in India, followed by Games. Technology & computing was No. 3, followed by Sports and Arts & Entertainment. Advertising campaigns running in these categories are seeing higher levels of engagement than any other, and in many cases, higher conversions as well.

Click-through rate in apps higher than that on mobile web

While comparing the value of apps vs. mobile web on Opera Mediaworks’ mobile ad platform in India, the click-through rate in apps is 1.7x higher than that on mobile web. Despite higher revenue from mobile web, revenue in app grew 2.9x year-on-year. Nearly 50 per cent higher than the average growth across APAC. However, across almost all Asia Pacific markets, app advertising revenue is overtaking the mobile web channel by as much as 13 times in Singapore and Thailand.

“High revenues generated from mobile web are a strong indication of increasing smartphone users from India that are spending time online. The reasons for preferring mobile web vs apps could range from device limitations to network conditions. However, we have observed higher returns for marketers spending on in-app advertising, specially in entertainment and gaming categories,” said Vikas Gulati, Managing Director, Asia at Opera Mediaworks.

“We hope this new report will serve the needs of Indian brands, agencies and publishers alike, as we aim to bring in key trends in mobile advertising, invaluable insights and category best practices that can be applied to their business,” he added.

Data trends from billions of impressions

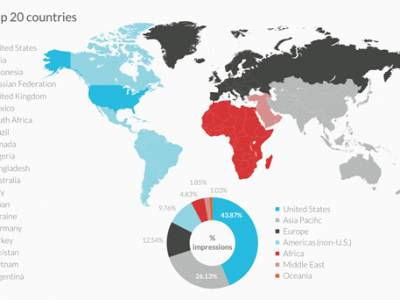

The report insights are based on Opera’s platform reaching over 1.4 billion users and include quarterly trends, advertising best practices, and what’s new in mobile technology and creativity.

Opera Mediaworks examined data from hundreds of global ad campaigns and billions of impressions served on the platform and combined it with some third-party data from external sources to paint a picture of where the mobile marketing industry is today, including “where the heat is” in the mobile app market and how consumers are interacting with mobile content and advertising messages.

Looking at data from the top 100 apps that use Opera’s mobile ad platform to monetise their traffic, it was found that mobile users in India are spending about 46 minutes each in each of these popular apps – longer than the global average of 30 minutes. The average session length of mobile users in India was 9.6 minutes, also longer than the global average of 8.5 minutes.

SDK technology is key for targeting

Technology can mean the difference between a poorly-targeted campaign and a highly accurate one, the report found. Advertisers that work with a mobile ad platform – as opposed to directly with a media company – must be assured of direct SDK penetration in order to increase the likelihood of reaching highly targeted audiences.

Opera Mediaworks is one of the largest mobile advertising and marketing platforms in the world, reaching an audience of 1.4 billion consumers globally. A fully-owned subsidiary of Opera ASA, Opera Mediaworks is a global organisation with over 20 offices worldwide.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn