Price and value of telecom services more important than brand: Study

Brand consciousness for telecom services is significantly lower for users in India. Yet most users believe their mobile telephony experience is driven by the quality of the mobile phone network, according to the findings of PwC's Consumer Value Survey. The survey seeks to understand the economic, social and personal benefits derived from services across sectors by Indian consumers (SECs).

Most mobile phone consumers in India largely derive value from mobile telephony by way of a feeling of security, being in touch with their family, helping them co

in saving time and expanding their social network. Newer users value the feeling of security that mobiles give them more than those who have used mobiles for a while.

However, the survey finds that the value proposition derived from any se segments, is fully established in the first year, and no further value growth is felt after that.

The survey also reveals that coverage remains the largest determinant and newer users are the most likely to switch.

Mohammad Chowdhury, Leader feel that the mobile is good value for money and 80 per cent believe that the mobile is important to them. However, there are 20 per cent consumers who do not see much value in mobile telephony. The survey delivering a superior user experience. This presents them with the opportunity to

differentiate their network on range, speed and quality.”

No customer segment values brand above price or value important than recommendations.

SEC C has the lowest brand consciousness but the highest price and value consciousness.This segment, comprising the skilled working class, appears to be a tough

The switching tendency of SEC C is higher than the overall average.

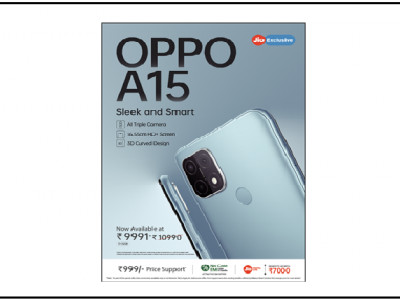

SEC D and E, making up 47% of India’s population, see least value in mobile telephony. There is thus room to take them up the value curve and thereby potentially improve revenue, the survey finds. SEC D is highly aspirational though, with users preferring significantly more money purchasing their next handset.

“Clearly there are various opportunity areas for telecom players as the survey results reveal. For instance, while awareness among data services users in Gujarat is relatively higher than those in Mumbai, usage is relatively lower. Marketers have an opportunity to drive more usage by understanding what users in Gujarat are really looking for Chowdhury added.

Similarly, while awareness levels in Assam are significantly lower than of mobile data services is surprisingly high. Operators can tap this opportunity to market

mobile services as a substitute for the lack of other entertainment options.Wi-Fi area that can drive growth for telecom operators

Advertising is given the lowest importance. The mobile users’ aspirations to buy a more expensive phone are largely irrespective of their sociosocio-economic status, the survey finds.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn