The good old days of traditional marketing are over: Girish Kalra, Tata AIA

Tata AIA Life Insurance Company Ltd is a joint venture company formed by Tata Sons and AIA Group Ltd. Being one of the fastest growing companies in the life insurance sector, Tata AIA Life has maintained its 5th rank based on individual weighted new business premiums. They are also one of the leading insurers in the Indian private sector.

The company recently appointed Olympic gold medallist Neeraj Chopra as their brand ambassador to endorse their product. A new campaign has been rolled out featuring Chopra as a digital first initiative, where the film captures the unpredictable nature of life through the lens of a sports personality like Chopra. In this film, the Olympian closely embodies Tata AIA’s core value – passion for excellence, where he has consistently set high benchmarks and pioneered change through his commitment and determination to his sport.

ALSO READ: Piramal plans to deepen penetration into Tier 3 & rural markets: Nitish Bajaj

In an exclusive conversation with Adgully, Girish Kalra, Chief Marketing Officer, Tata AIA Life Insurance, speaks about the company’s marketing approach, the emerging trends in the life insurance sector, how the company plans to leverage the strengths of Olympic gold medallist Neerja Chopra for the brand and more.

How is the role of the CMO undergoing a major transformation amid the pandemic and an increasingly digital-first focus? How is TATA AIA adapting to the new digital world?

The good old days of traditional marketing are over. New age marketing is all about dovetailing the art & science of classic marketing with new age technology. As such, the CMO’s role has got morphed into one that requires him/ her to be good at storytelling to consumers, albeit using digital tools that enable each consumer to be communicated as a unique entity. A skew on either side is not going to yield the desired results, while an absence of one of these two core elements is a sure case of obliteration going forward.

At Tata AIA, we had realised the speed at which this transformation was taking place. We have been accordingly reorienting our skill sets to adapt seamlessly and thrive in the MarTech age. We had invested in and deployed the key building blocks of the MarTech stack early on. Today, we are able to leverage these new age tools across consumer prospecting, onboarding, engagement and servicing.

Given the constant flux in consumer behaviour, especially in these pandemic times, what is your go-to strategy to understand your customers’ unique wants and needs?

As consumer behaviour continuously evolves, it is important to revisit the methods to unearth the same. Gone are the days of doing annual or 6-monthly comprehensive research exercises through traditional modes.

At Tata AIA, we have shifted to ways that enable us to continuously map consumer behaviour as they experience our services or respond to our communication. Further, these insights are transferred to the relevant stakeholders at regular intervals to ensure the necessary changes in our proposition are made in line with consumer preference.

Storytelling is a new way of conveying your brand message. What’s your view on this? How does this work in the Life insurance category where you need to tell a compelling story to educate your audience?

Storytelling has always been and will remain the preferred way of conveying a brand’s message. When it comes to the life insurance category, the science of storytelling becomes even more critical.

At the core, life insurance solutions meet the emotional needs of consumers, be it the feeling of having secured the future of our loved ones or the assurance of having ourselves covered and hence, in a position to dream big. Within these broader themes lies a unique story for each one of us.

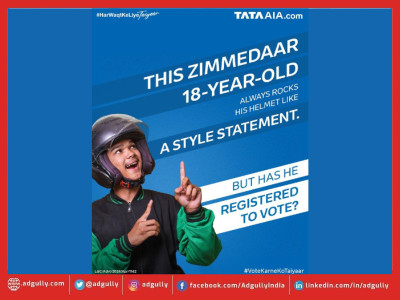

At Tata AIA, we understand the role that life insurance plays in the life of our consumers and we accordingly convey our messaging through stories that touch an emotional chord with them. Our latest campaign – #HarWaqtKeLiyeTaiyaar – with Neeraj Chopra is a step in this direction as he shares his perspective on the highs and lows that a sportsman goes through in his career – something that each one of us experiences as we navigate the journey of life.

Aligning with Neeraj Chopra is a good strategic move as he has mass appeal. How do you plan to leverage the Olympian through your campaigns and what’s your end objective in collaborating with him?

Yes, Neeraj Chopra is a strategic fit for our brand for several reasons. As a group, we have always supported Sports. Further, as I mentioned earlier, Neeraj’s career story is a journey of experiencing moments of triumph as well as times of despair. As a life insurance brand, our focus is to partner with and support our consumers as they strive hard to realise their dreams while trying to overcome the challenges that life throws at them. Secondly, Neeraj strongly believes in reaching his milestone early on – his Olympics final expedition was

exactly this – go the maximum distance in the initial throws. This is exactly what we propagate to our consumers – get the protection of a life insurance solution early on in life. At the same time, his ingenuity and connect with his roots align very well with our brand philosophy.

The pandemic has shifted many of the businesses to online, including financial brands. Have you seen customers moving in a significant manner to buy policies online? What’s the trend looking like for the future?

While the pandemic did accelerate consumer adoption of online platforms, including completing the transaction, it is still early to say whether this will play out in the long term. Having said this, online has been increasingly finding a place in the consumer’s purchase journey. Various studies initiated by us point to multiple online interactions being done by prospective buyers even if the purchase concluded in the offline mode.

Be it searching for the right solution online, comparing features and benefits on an aggregator site, reaffirming hypothesis with reviews of other consumers – online platforms play a critical role in terms of educating and assuring consumers of their purchase decision. As digital tools evolve, the importance and capability of online as a platform will increase multifold. What is important in this scenario is that brands ensure a seamless experience for consumers as they toggle between online and offline in their journey to purchase.

Influencer marketing helps in raising brand awareness and generating sales leads. Do life insurance brands bank on influencer marketing to drive business and to what extent does it help a brand like Tata AIA?

Each one of us aspires to achieve our dreams in life and gets inspired by those who have walked that path. Their success gives us the confidence that what we aim for is possible to achieve.

At Tata AIA, we look at influencer marketing as going beyond helping us increase the reach of our messaging. For us, the influencer is a partner who works with us to ensure our brand story reaches our consumers and resonates with them deeply. This has been our thought process behind signing up with Neeraj Chopra and will continue to drive our marketing efforts.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn