Three in ten urban Indians use PharmEasy

A third of urban Indians regularly buy from online pharmacies but most consumers reside in metros

A third of urban Indians (32%) say they regularly consult an online pharmacy or buy from an online health platform. Just as many (31%) said they did so during the pandemic but not anymore.

Furthermore, one in twelve urban Indians haven’t accessed these platforms yet but are eager to try them out (8%). Some have not used these platforms for any service (20%) or are not aware/ do not have access to them (9%).

Ordering medicines and health products is the biggest reason to use these platforms, followed by consulting a doctor, booking a test or for reading some medical content.

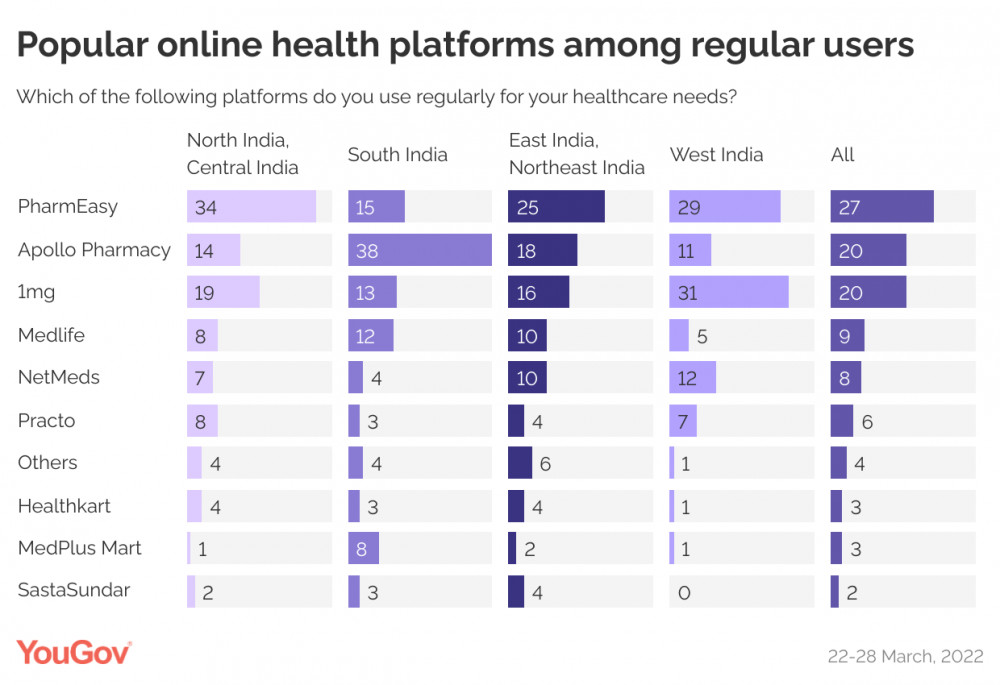

Among those who are regular buyers/ users of online health platforms, PharmEasy is the most popular platform, and nearly three in ten (27%) use it regularly to meet their healthcare needs. Apollo Pharmacy and 1mg are next with a fifth (20% each) saying they regularly use these platforms. Medlife, Netmeds are Practo are other popular brands.

Notably, Apollo Pharmacy is more popular among young adults between 18-29 years as compared to the other age groups (at 29%). It is also more dominant in South India as compared to the other regions (at 38%). On the other hand, PharmEasy has a greater popularity in North India (at 34%) while 1mg is more dominant in West India (at 31%).

Penetration of online pharmacies is higher among adults between 30 and 39 years (38%) as well as those residing in North India (36%) and tier-1 cities (38%). On the other side, tier-3 residents are more likely to say they are either not aware, do not have access or haven’t yet but are eager to try them out. The covid-19 pandemic gave a boost to the demand for e-pharmacy in metros and big cities, however in order to grow further brands will need to penetrate smaller towns and cities to create greater awareness and interest.

Of those who have tried or regularly use these platform, nearly two-thirds (64%) rate their experience of using them good and only 9% called it bad. In addition to having a good user experience, most of those who use them regularly say they trust these platforms (78%). Trust is high even among those who have not used these platforms yet, as they are more likely to say they trust than not trust these platforms (47% vs 14%).

While there is trust, there are barriers to trial and usage among those who do not use these platforms. Comfort with local doctors and offline pharmacies emerged as the top reason for not using these platforms (at 46%), followed by lack of experience using these platforms (35%), problems of exchange (26%) and delivery charges (25%). In order to encourage these non-users to become consumers, brands will need to overcome these barriers in order to install greater trust among them.

When it comes to motivations to buy from online pharmacies, convenience and better prices & discounts than offline stores emerged as the top reason that would motivate current non-users to buy from online stores or consult an online health platform. Following this, faster consultation, availability of substitute medicines, family recommendations, authenticity, additional services, and greater anonymity were stated as some other reasons that would encourage people to buy from an online pharmacy.

** Results based on YouGov Omnibus survey between 1027 urban Indian respondents between March 22-28, 2022

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn