A breakdown of Coca-Cola’s enduring brand management strategy

Value investors Ramaswamy Ranganathan & Sudarshan Rajan analyse the power of Brand Coca-Cola as well as the strategy of the brand in terms of the financial advantage that it bestows on its investors.

In today’s global world, the power of brand is a great competitive advantage to have and a true brand in the overall portfolio of the company gives itself a huge financial advantage too. In fact, one can argue vehemently that if a brand doesn’t configure financial advantage to the company through higher margins, cash flows, working capital or pricing power, you can argue it is not a brand at all only a presence of a logo with no financial advantage only a cash drain.

There have been many brands which have faced death even though consumers preferred them, classic examples have been Jet Airways & Kingfisher Airlines, in the recent times. At the same time, you have a classic consumer brand called Apple where consumer loyalty is at its peak survey after survey and it has all the ingredients of being called a brand due to the financial advantage it confers on the company.

Bruce Henderson elucidates this with great clarity, “Business success cannot be measured until the direct investors cash input has been returned with his profit, until then all profit and apparent success is only a promise.” Bruce went on to further add that reported profit is only a signal.

Investors pump capital and expect compounding with safety and managers of the brand want opportunity and defendable security. Growth seeks to provide answers to both and growth optically looks very promising. Most forget growth sucks capital and will keep on sucking it, till the market grows to a maturity stage or the firm achieves a dominant share where growth leaks straight into the kitty of the largest market share holder. Take the case of Amazon, any growth in the e-commerce business will straight away leak into the Amazon kitty and the network effects will keep compounding.

Brand Management in today’s day and age is beyond the function of Marketing and it needs straight involvement of the Top Management of the Business. To defend a brand, cash needs are compounded and, in the hope, that Brand or the Business compounds growth in favorable terms to the firm. Business superiority at the start of the cycle is no evidence of dominance, initial profits are at best promise, but the ultimate test is how much the brand is able to generate free cash flows and how far the brand can be stretched in favour of shareholder returns is the true test of a Brand.

Let us study a great brand globally – Coca-Cola – to elucidate the strategy of a brand in terms of the financial advantage that it bestows on its investors.

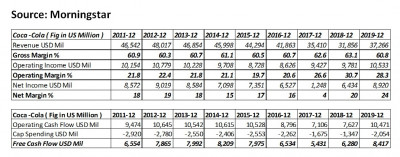

The revenues of Coke have been pretty inconsistent with a decline of sales from peak $48 billion in 2012 to $37 billion in 2019. The most notable feature is the Gross Margins, Operating Margins and Net Margins which are more or less intact with a blip in 2017, but recovering back to the mean even after declining sales. The first indicator of any competitive advantage on any Brand is its Pricing Power, and for Coke it makes all the more noteworthy because even after decline in sales the power of the brand through its pricing power remains intact.

Pricing power is one of the most enduring determinants of high returns. The derivative of pricing power is usually only from two main sources. First and foremost is a concentrated market structure, where the number of players effectively limits the number of new entrants and creates a huge entry barrier resulting in a highly oligopoly structure or duopoly market structure.

The second source is Intrinsic pricing power which is a derived from intangible assets of a product or a service. In case of Coke the benefit is directly from both the sources, globally the soft drink industry is a highly concentrated structure with a duopoly play in the competitive arena.

This kind of a structure is clearly seen in the margins of Coke being maintained even though sales are declining and yet the Power of Brand pulls it through coupled with the industry structure in which it operates.

It is also pertinent to note that primary driver of profitability is supply side rather than looking at demand side, yet majority of the managers focus on demand and forget the supply side. Demand projections are not only difficult to gauge but also filled with significant errors, supply side makes the picture look clearer and fairly accurate. In case of the global soft drink industry, supply side is clear, demand projections are more of an estimate, due to multiple factors of subjectivity, yet most projections will have slides focusing on demand rather than supply side.

Coke has an enduring competitive advantage in local distribution, where it dominates few markets and the media spends drives the message of communication leading to a great consumer advantage. The critical thing to focus is on understanding the interactions between Local distribution, Media Spends, and Consumer understanding.

Majority of the marketers focus only on media spends as it is easy to spend resources, layer it with demand projections, which are not only error prone but also resource consuming, and then focus on digital assets like Facebook Likes, YouTube views to show return on marketing investment is delivered, forgetting the basic lesson of business – that a brand needs to be enduring in its economic performance, of returning the capital invested by investors with the promised Internal rate of return (IRR ) and not only performing on Media Metrics, which in isolation has no value to the business owner. Coke, in all its fairness, has not only retained itself as one of the most valuable brands in the world, it also has enriched the promise of returns to shareholders and consumers in equal footing, making the brand remarkable in its journey.

Coke has been a phenomenal brand with great returns to its shareholders and with Berkshire owning 9.3% of Coke. Berkshire had invested $1,299 million and the value as per the latest annual letter is $22,140 million. Cash is all that counts in the long run, and the Coke Brand has been a phenomenal financial powerhouse enriching its shareholders, in fact this stock doubles the money for Warren Buffett on his original investment of $1,299 million only through way of dividends every 2 years which is stupendous.

Bruce Henderson has perfectly summed it up, all true profits payable to the original investor must be represented by the cost superiority differential over the highest cost marginal competitor who must reinvest his net cash generations just to hold his position. The Coca-Cola brand has been able to deliver what a business owner would be proud of in generations to come and also leave its indelible mark on the business fraternity to learn the principle of Brand Management in its true sense

Also Read:

Coca Cola India ropes Taproot Dentsu to launch Aquarius Glucocharge

Coke has its eyes set on doubling size of business in 5 years: James Quincey

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn