A good health for a good life stresses campaign by Bajaj Allianz Life

Good health is essential for a good life as well as securing you and your family’s future. However, in this stress-filled world, critical illnesses are on the rise. The expenses gone towards managing them can negatively impact the financial well-being of you and your loved ones. Therefore, it becomes necessary to have a comprehensive health insurance plan with critical illness cover for you and your family. It provides complete financial support in case the need ever arises.

Bajaj Allianz Health Care Goal is a critical illness health insurance policy which covers 36 critical illnesses including heart and cancer, with an option for family cover & return of premium. This critical illness cover also offers an inbuilt waiver of premium rider. A lump sum amount is paid to the life assured on diagnosis of any of the 36 critical illnesses.

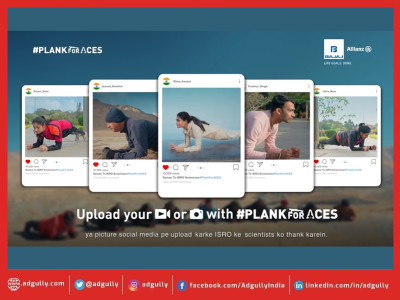

Chandramohan Mehra, Chief Marketing Officer, Bajaj Allianz Life Insurance, said, “The consumer engagement #36SecPlankChallenge is anchored on the product’s benefit of 36 critical illness coverage and engages consumers meaningfully with the brand and product while supporting a good cause. We believe uninterrupted health is a key to achieving life goals. We are confident that the initiative will kick-start the plank movement across India.”

There are four variants in this critical illness health insurance:-

- Critical Long Term Health Care – Individual Cover

- Critical Long Term Health Care Plus - Individual Cover with Return of Premium at Maturity

- Long Term Family Health Care – Family Cover

- Long Term Family Health Care Plus – Family Cover with Return of Premium at Maturity

Some of the key benefits of this plan are:

- Acts as financial support for your family: Critical Illnesses may not only result in the risk of your life but also result in the loss of income. The burden of such contingencies can be devastating which is why you need to have a health plan in place to take care of you and your loved ones.

- Covers 36 Illnesses: Sum Assured applicable will be paid on diagnosis of any of the 36 illnesses.

- Option to cover spouse and dependent children: Under Long Term Family Health Care & Long Term Family Health Care Plus, you can cover your spouse and dependent children.

- Return of premiums at maturity: If no critical illness benefit is availed by any of the Life Assured(s), the total premiums paid till maturity for the Life Assured(s) will be paid as the maturity benefit.

Additionally, by paying premiums regularly on your critical illness health insurance plan, you can avail tax benefits on health insurance premium under section 80D of the Income Tax Act, 1961.

Anchoring on our newly launched Bajaj Allianz Life Health Care Goal that covers 36 critical illnesses, we're contributing towards curing heart disorders of disadvantaged children for every post tagged with the hashtag #36SecPlankChallenge.

So, let's start planking for a healthier you, and also a better world.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn