A lot to chew on for food aggregators? Kalagato analyses the recovery story

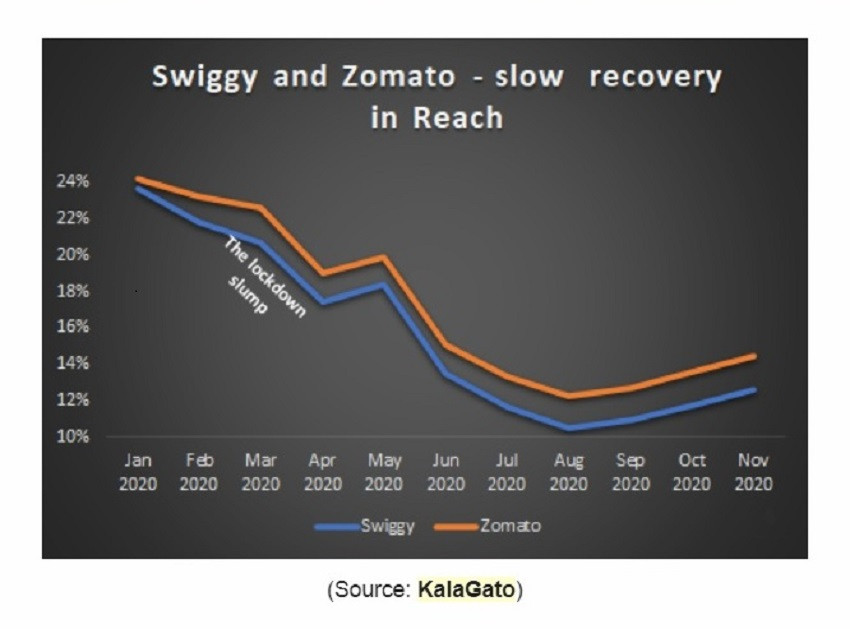

2020 was an interesting year for food delivery, both for aggregators (Zomato/ Swiggy) and standalone brands (Pizza Hut/ Dominos). Even as peak lockdowns shut restaurants, the dependence of many consumers on delivered food possibly increased. However, the larger theme has been that of a slowdown; the end-March to end-April lockdowns were the strictest, and its impact can be seen in plummeting reach of the two largest players, points out Kalagato in a blog.

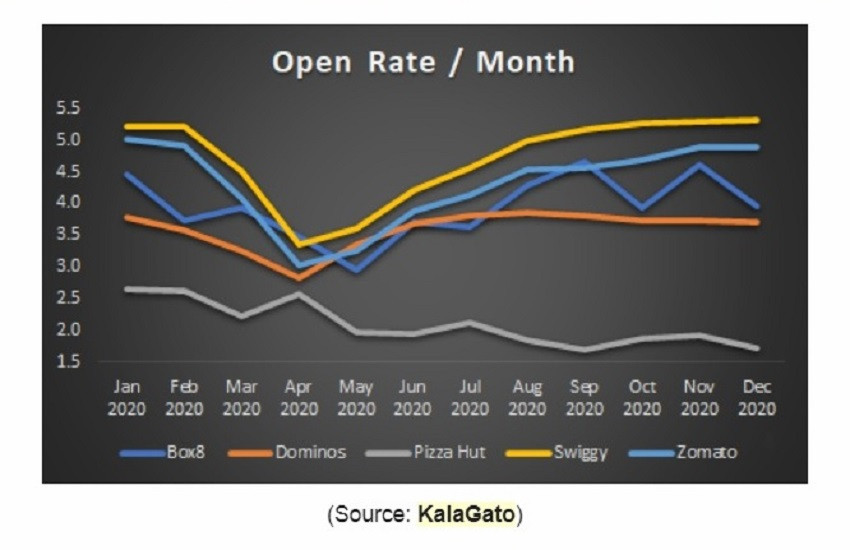

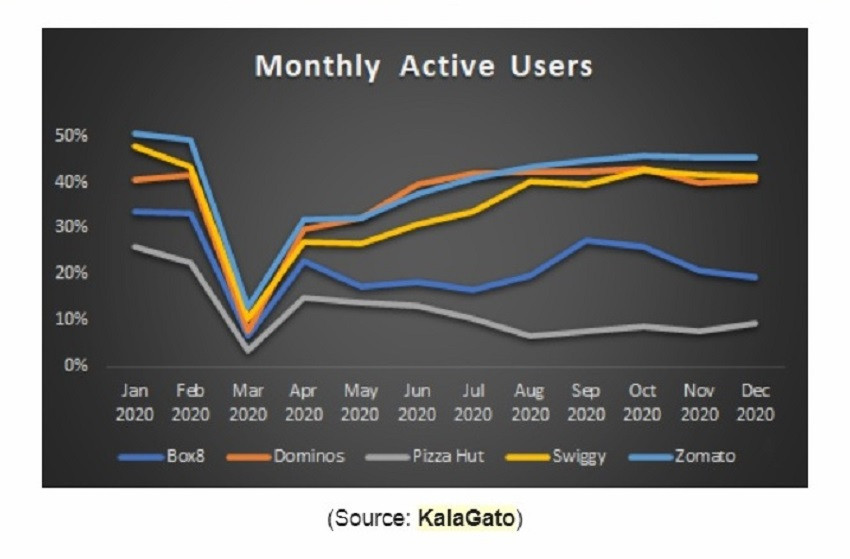

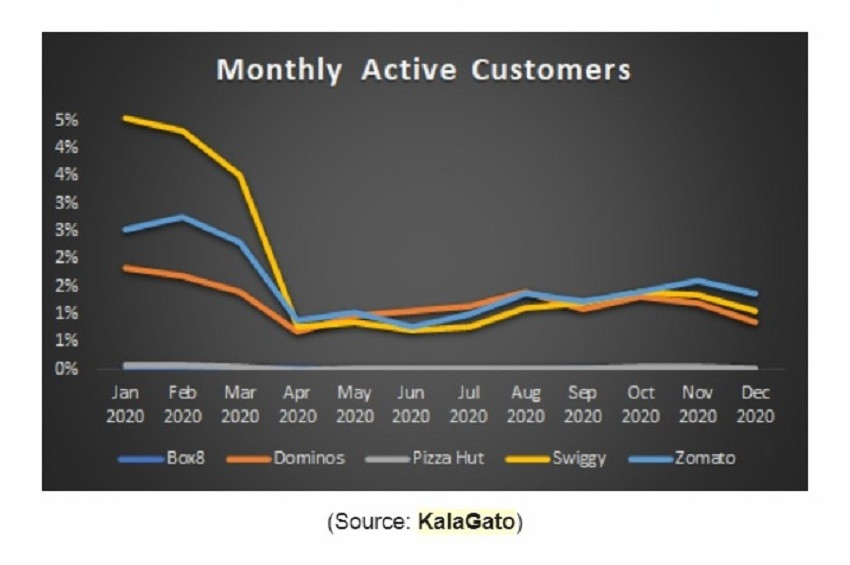

According to Kalagato, open rates and monthly active users show recovery towards pre-lockdown levels, but users who open apps don’t count; paying customers do.

On this count, demand has not recovered much from April. Monthly Active Customers are the unique number of monthly customers transacting on a particular platform. To that extent the performance of Domino’s has been most consistent.

This begs the question(s):

- Have a lot of people made a permanent adjustment to home-cooked food?

- Or is it an ongoing concern for safety?

- Or is a lower transacting population representative of lowered spending power/ disposable income?

All of the above perhaps…

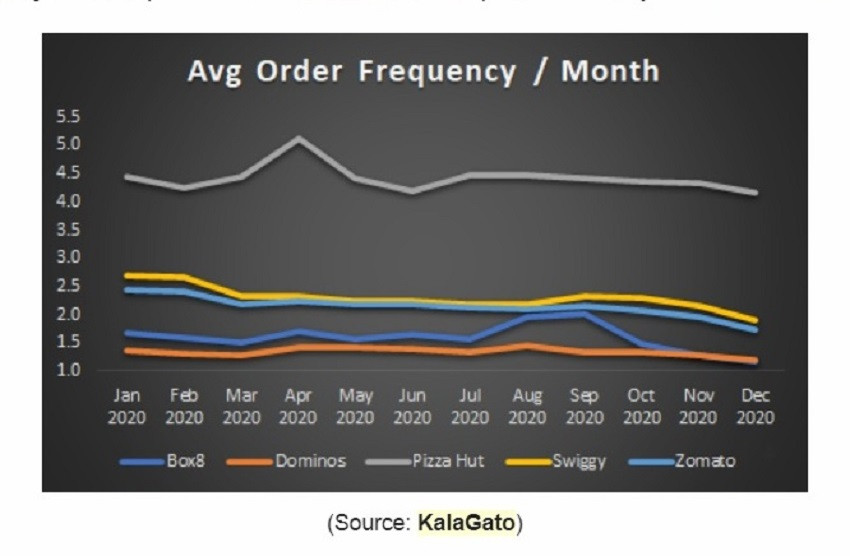

For the sticky users who continue to transact, there hasn’t been much change in how often or how much they order; the lockdown period saw frequency and value hold steady thanks in part to the outlets that remained open for takeaway:

The pandemic is a hiccup, not a show-stopper. According to a joint report by BCG & Google, online food delivery in India as a percentage of total dineout stands at just 4%, far behind developed countries like the US and UK (at around 9.5%), and China (13%). So, plenty of room to grow with a much larger addressable market (albeit with lower spending power).

Platform Extensions/ What Else can My Riders Deliver?

The uptick in usage towards the end of 2020 for aggregators like Zomato/ Swiggy is likely coming from a focus on new categories like alcohol (gives ‘Swiggy’ a whole new meaning!), grocery (Swiggy Instamart moving into Amazon Fresh/ BigBasket territory), and wellness products.

Cross-selling products and improving network utilisation makes inherent sense. Two questions businesses ask themselves:

- Why can’t we keep our riders busy through the day and not just at meal times?

- What else can we ‘credibly’ sell to our customers?

Being category agnostic clearly helps utilise scale. The Kalagato blog here mentioned about Uber, which had done this with Uber Eats in 2015 and more recently bought out alcohol marketplace Drizly for $1.1 billion to sweat its network more. (Read More).

Speed is a drug – even next day delivery is too late and in the post-pandemic world, hyperlocal offers more opportunities than just food & grocery. As with jokes, hyperlocal success is all in the ‘delivery’! This is a space the delivery giants are stepping into (Swiggy Stores hosts products from small stores), while holding onto the food delivery business, which is somewhat less competitive now thanks to the ‘exit’ of players like Food Panda and Uber Eats.

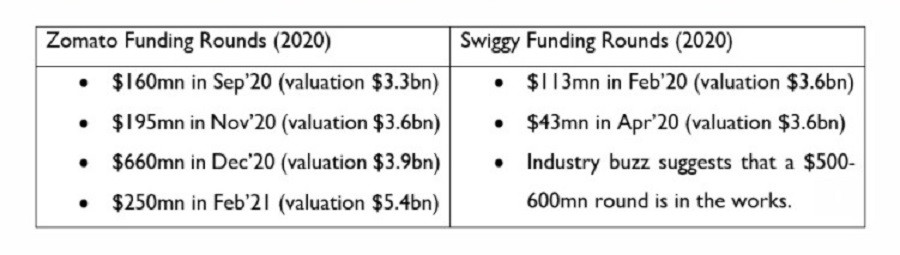

Building war chests

As per various media reports, aggregators are clearly building their war chests for this expansion.

Diversification away from food delivery was always on the anvil and perhaps a long time coming; the pandemic precipitated it.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn