Consumer sentiment strengthens in September for urban Indians

Consumer sentiment has further strengthened and improved in September for urban Indians, according to the Refinitiv-Ipsos India Primary Consumer Sentiment Index (PCSI).

The monthly PCSI result which is driven by the aggregation of the four, weighted, sub-Indices, has surged for all the 4 sub-indices: the PCSI Economic Expectations (“Expectations”) Sub-Index is up 1.0 percentage points; the PCSI Employment Confidence (“Jobs”) Sub- Index has increased by 2.8 percentage points; the PCSI Current Personal Financial Conditions (“Current Conditions”) Sub-Index is up 3.2 percentage points; and the PCSI Investment Climate (“Investment”) Sub-Index is up 3.2 percentage points.

Summarizing on the findings of the survey, Amit Adarkar, CEO, Ipsos India said, “We see a further improvement in consumer sentiment in September among urban Indians, after a major upturn witnessed in August 2023. Sentiment is up for the economy (though marginal), jobs, personal finances and investments. Buoyancy is good news for marketers as consumers will be willing to loosen their purse strings with the festival season already taking off in different parts of India. Monsoon situation has improved in September after the August deficit. Also, the food inflation is down from the highs of July.”

“Hiring is also seeing an uptick, with India being one of the fastest growing emerging markets,” added Adarkar.

Since March 2023, Ipsos India has moved the survey from covering only netizens to include an expanded offline sample, using the Ipsos IndiaBus – 1800 offline sample + 400 online sample, covering 16 cities across the length and breadth of the country, scientifically chosen, from NCCS A, B & C. More representative of the urban population.

Ipsos IndiaBus is a monthly pan India omnibus (which also runs multiple client surveys), that uses a structured questionnaire and is conducted by Ipsos India on diverse topics among 2200+ respondents from SEC A, B and C households, covering adults of both genders from all four zones in the country. The survey is conducted in metros, tier1, tier 2 and tier 3 towns, providing a more robust and representative view of urban Indians. The respondents were polled face to face and online. We have city-level quota for each demographic segments that ensure the waves are identical with no additional sampling error. The data is weighted by demographics and city-class population to arrive at national average.

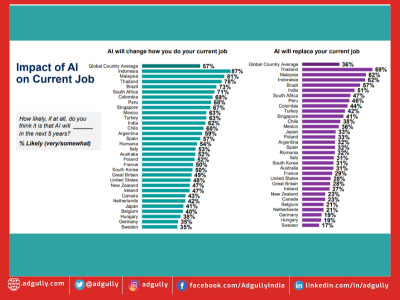

Consumer Sentiment in 29 Countries – Parts of Asia and Latin America most buoyant.

India has moved up to the 2nd spot in ranking, across the 29 markets polled.

How we did it

These findings are based on data from a monthly 29-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI).

The results are based on interviews with over 21,200 adults aged 18+ in India, 18-74 in Canada, Israel, Malaysia, South Africa, Turkey, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online.

The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Turkey.

Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Turkey are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones.

The data is weighted so that the composition of the sample in each country best reflects the demographic profile of the adult population according to the most recent

census data.

The global indices and averages reported here reflect the average result for all the countries and markets in which the survey was conducted. They have not been adjusted to the population size of each country or market and are not intended to suggest “total” results.

Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error. The precision of Ipsos online surveys is calculated using a Bayesian credibility interval with a survey of N=1,000 being accurate to +/- 3.5 percentage points and a survey of N=500 being accurate to +/- 5.0 percentage points. For more information on credibility intervals, visit this page.

The LSEG/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of their local economy, personal financial situation, savings, and confidence to make major investments. The PCSI metrics reported each month for each of the countries surveyed consist of a “Primary Index” based on all 10 questions below and of several “sub-indices” each based on a subset of these 10 questions.

The publication of these findings abides by local rules and regulations.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn