COVID-19: Nielsen decodes evolving consumer trends & Future Consequences

During the early pandemic cycle in the world, there was an astronomical rise in consumer purchases led by news cycles and lockdown announcements. As a result of economic activities getting unlocked amidst a prolonged crisis timeline than initially anticipated, Nielsen has come up with a framework ‘Covid-19 Future Consequences’, which finds out that purchasing habits are being driven by external factors and socio-economic circumstances – now and in the future.

According o the Nielsen report, there are four emerging patterns that are reflected in the global COVID-19 framework being driven by re-openings of businesses and economy, lifting of restricted living conditions and concerns about economic downturn and macro factors.

Also read: Nielsen Compass: A World-Leading And Powerful Campaign Outcomes Database

- Basket reset: What consumers will buy

- Homebody reset: Where consumption will happen.

- Rationale reset: Why do consumers make purchases

- Affordability reset: How much will consumers spend

The four identified facets of behavioral reset offer valuable insight into how prolonged COVID-19 impact will transform consumer and related business decisions moving forward.

Key Consumer Behavioural Shifts Driving Future Consumption Pattern

“When we consider India within this framework, we see clear evidence of the basket reset, weighted by the affordability reset. The tension in the consumer basket is that they are trying to reconcile the old needs with the new ones; the health/ hygiene and product value proposition competing with each other,” remarked Diptanshu Ray, Lead, Retail Intelligence, South Asia, Nielsen Global Connect.

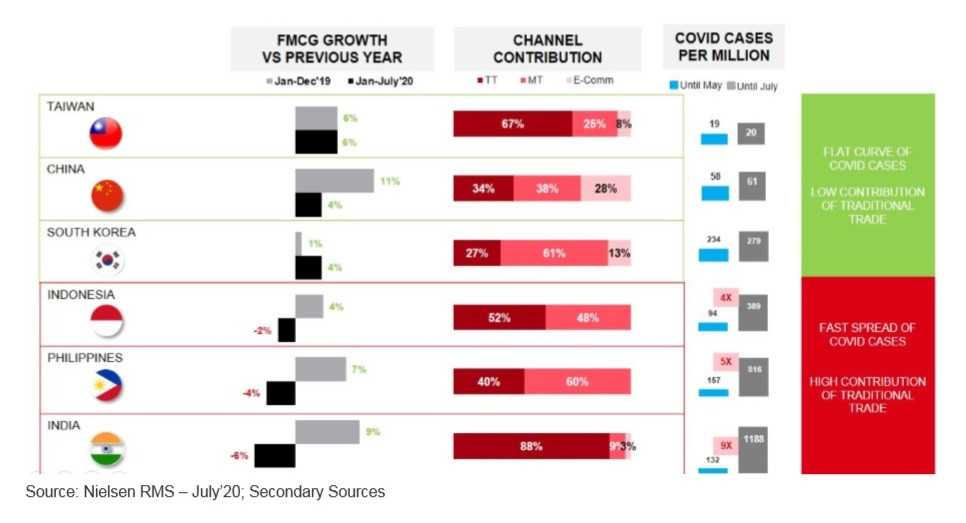

FMCG Growth in Asian Markets Impacted by Severity of Pandemic & Reliance on Traditional Trade

While studying the performance of the FMCG industry among Asian countries, Nielsen found that there were two differentiators:

- a) spread of pandemic especially as markets moved in unlock phase, and

- b) contribution of traditional trade channels to total FMCG value sales.

South Korea and China had flattened the curve of new cases from May to July and they have just around 30% of total FMCG sales coming from traditional trade channels. These countries clocked a decent growth (4%) in FMCG sales in the January-July period of 2020 over the same period of last year (SPLY). Taiwan also had a remarkable industry growth (6%) in the same period, despite having a significant (67%) contribution of traditional trade channels. However, the pandemic spread was checked in Taiwan with the least number of cases (20 per million) until May 2020 – the number went up just by ‘one per million’ over the next two months.

On the other hand, markets like India and Indonesia have high dependence on traditional trade channels and witnessed a much faster spread of the pandemic in June-July. Both these markets had negative FMCG industry growth in the January-July period vis-a-vis the same period last year. The Philippines, too, had a negative industry growth in the 2020 calendar so far despite having significant contribution from organised trade; but the pandemic spread was very fast, causing a blow to the industry growth.

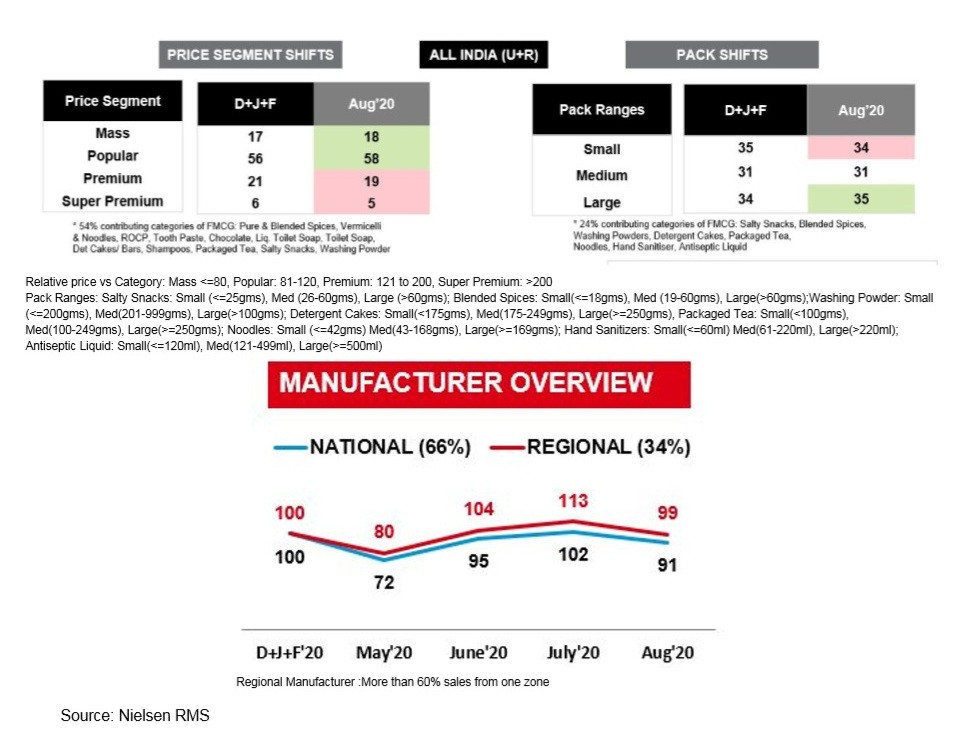

With Unlock, Indian Macros Show Restrained Revival

India had one of the longest and strictest lockdowns in the world. Most key macro indicators were in the red through the early days of the lockdown. Post June, unemployment levels and ‘number of closure days in a month’ for FMCG outlets has gone back to pre-COVID times. However, underemployment rates are reported to have gone down with the hardest hit jobs were that of professionals, viz. Engineers, Accountants and Teachers. Likewise, stores have not been opening for the whole day period that they were. These reflect in the overall economic progress and in GDP numbers. Restrictions during the lockdown period brought in significant impact to economic activities in all spheres of life and industry in the country. Non-essential indices (Lubricants, White Cement, White Cement Putty, Spirits (alcoholic beverages, etc.) dipped significantly during the lockdown, gaining gradually but still to reach pre-COVID levels. On the contrary, with the unlock, the FMCG consumption witnessed an early rebound in the months of June and July. This was on the back of suppressed demand during the lockdown period, and reflected more prominently in non-food categories beyond essential baskets. With the pent up demand satiated in June-July, August has seen a muted performance for the industry. As the industry is evolving, consumers have shifted their preferences when it comes to price tiers, pack sizes and product assortment. Manufacturers and retailers, on the other hand, are guided by the consumer perception and behaviour and are strategising to adapt to the cautious revival of the industry.

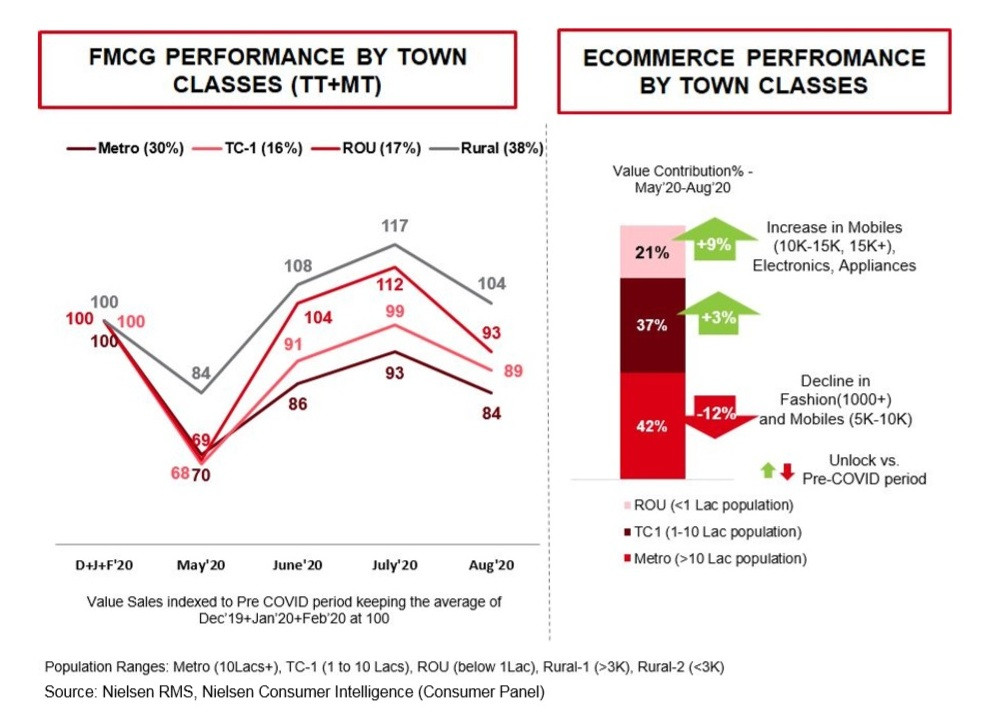

‘Bharat’ Driving Strategic Priorities

FMCG consumption was the hardest hit in bigger cities in India during the lockdown period, the impact was the least in India’s villages that retail close to 40% of industry sales. Nielsen’s analytics solutions of E-commerce channels show the same phenomenon reflecting in different sectors beyond FMCG as well, where there is an increasing contribution of lower town classes to overall E-commerce in the period of May to August vis-a-vis pre-COVID levels.

In this evolving Unlock situation, Nielsen reached out to 14 corporate leaders from leading Indian manufacturers and retail giants in the month of September. The survey brings in detailed insights around the current market situation, its impact on their businesses, their coping mechanisms and strategy for the upcoming months

This increased focus on Middle India & Rural was also reiterated as the majority of CXOs (connected in September 2020) claim that they are increasing focus on Middle India and Rural markets over the next 6 months.

Affordability: Consumers seek Value Proposition as Wallets Shrink

There is a visible sign of consumers either downgrading to more affordable (Mass & Popular) offerings or shifting towards value for money large packs. Also, private label share going up in Modern Trade Brick & Mortar channel and Regional players performing better than the national players during the COVID period hint at affordability reset in the play.

Prioritisation of Items by Manufacturers & Retailers Leading to an Optimised Store Shelf

Retailers are rationalising assortment by operating with fewer items to focus investment and shelf space on fast moving items. This strategy of assortment rationalisation is echoed by the industry leaders also – 36% CXOs Nielsen talked to stated their plan to rationalise consumer offerings in the next six months.

Innovation: Shifted to Focus on Current Market Needs

Focussed innovation is another trend in sight. There is a significant increase seen in the number of players entering the Health & Hygiene basket with categories such as Hand Sanitizers, Hand Washes, and Antiseptic Liquids. Similarly, in-home cooking basket (Ketchups, Jams, Cheese, Milk powders, etc.) are gaining prominence and are witnessing increased innovation in the market. Contrary to this, out of home consumption categories such as salty snacks and chocolates; and Beauty Basket (Skin Care, Lipstick, and Fragrances) have had fewer new players entering the market in the last few months. The CXO connections also corroborated this fact.

E-commerce FMCG Continues to Hold on to recovery

As the FMCG industry in India is seeing a cautious recovery, E-commerce channel with a small base (3% of total FMCG sales) has shown resilience against the tough times.

“The E-Commerce channel is seeing a “sale” triggered cautious recovery. The shoppers today are anticipating and holding back their purchases for sale periods. While some categories such as home appliances are seeing a pent up demand in lieu of safety and personal home convenience. We believe the festive season will see a big release of this pent up demand with e-commerce players gearing up for the upcoming sale season,” noted Kunal Gupta, Lead, Consumer Intelligence, South Asia, Nielsen Global Connect. In the e-commerce space, major categories such as fashion witnessed a restrained recovery and there has been greater demand for mobile, home appliances & electronics online during the unlock period. This is a result of pent up demand from lockdown, coupled with recent sales by e-commerce players. The steep jump in sales by 1.3X times during the ‘freedom sale’ in August indicates consumer sentiment towards deal seeking and price consciousness.

- Restrained spending during lockdown is enabling consumers to prioritise spending on categories to improve quality of living at home. This is indicated by the steep increase in sales of categories like televisions, water purifiers, washing machines, and grooming devices too. Work and education from home has led to an increase in sales of laptops for consumers.

- Mobiles continue to enjoy nearly half of the share (48%) of online sales and smartphones with price range >15K range have doubled in this period indicating consumers need for staying connected with uninterrupted access to media and communication.

- There is a steady adoption for FMCG online with first-time shoppers increasing month on month to 36%. The consumer spends and basket sizes are continuing to expand online.

- Less than Rs 500 Fashion/ Apparels have grown by 28% and now contribute to 40% of the category as shoppers lower spends from Rs 1,000 or more. This is resulting in slow recovery despite the slight boost from the sale period in June.

CXO Speak About Strategy Shifts

With the lockdown easing up, challenges that businesses were faced with are seeing some respite, as claimed by industry leaders in a study undertaken by Nielsen in the second half of September 2020. Bringing production up-to-speed, difficulty in sourcing raw materials, challenges to get products to retail outlets, limited opening hours/ store closure were the key challenges faced during the lockdown. With the economy unlocking, some of the big challenges that keep the leaders worried are the limited opening hours of outlets in a day and decline in consumer demand.

Majority of the corporate leaders are now optimistic of an improved business environment, with two-thirds anticipating a positive impact on their businesses over the next four months, that is, rest of the calendar year 2020 – incidentally this period coincides with the festival season in India.

In this constantly evolving situation, new consumer needs have emerged that businesses are continuously working to address the same. Some of these emerging consumer trends are increased adoption of e-commerce and seeking products delivering protection for self and family from germs/ bacteria. Apart from these, consumers are actively looking out for safety and hygiene practices at various consumer touchpoints.

These consumer needs are resonating with corporate leaders, who are crafting strategic actions, viz. increased engagement and investments on expanding digital footprint, reprioritisation of capacity to rationalise product mix, and review communication strategy to convey safety/ health/ hygiene benefits.

Companies need to address emerging health and safety trends of the consumers. As consumers are more homebound and relying more on online services, increasing digital and online investments could be beneficial. Companies unable to provide products that can fit the adjusted wallet and price sensitivities may ultimately lose long-term traction with core users. With dynamic times, it will be critical for manufacturers and service providers to be close to the changing consumer trends and behaviour and adjusting strategies accordingly.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn