ETMONEY becomes the go-to app for investors

With global economic uncertainties triggering a 95% slump in equity net sales, according to key data released by the Association of Mutual Fund in India (AMFI), ETMONEY - India’s largest online wealth management app continued to generate higher value by driving 28% of equity net sales of the industry in June ‘20, thus reaffirming its position as the country’s go-to wealth management app.

As per the latest data released by the Association of Mutual Fund in India (AMFI), net inflows in equity mutual funds in the month of June 2020 fell by almost 95% to Rs. 240 Cr from Rs.5,256 Cr in May. Amidst the chaos, ETMONEY surged ahead by contributing a major chunk of net sales while ensuring that capital was invested in categories aimed at long-term wealth creation.

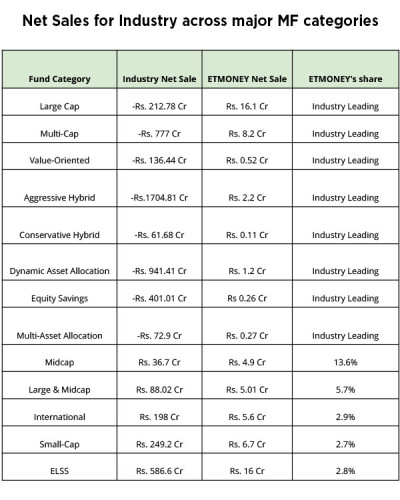

Out of the industry’s equity mutual fund net sales, ETMONEY accounted for Rs. 68.7 Cr in investment i.e. 28% of net sales of the whole industry. At a time when large-cap and multi-cap funds posted a combined negative net sale of close to Rs. 1,000 Cr, ETMONEY saw net sales in excess of Rs. 25 Cr in these two categories. ETMONEY also accounted for nearly 14% of total net sales in the Mid Cap category in the month of June. As compared to the industry-wide net sales of Rs 36.70 Cr for the category, ETMONEY contributed a net sales of Rs 4.9 Cr. Besides equity funds, the platform also saw net positive sales in hybrid funds while the industry had over Rs. 3,000 Cr negative net sales excluding arbitrage funds.

Speaking on the platform’s success in helping Indian investors make smarter financial choices, ETMONEY Founder-CEO Mukesh Kalra said, “We have undertaken various initiatives to help Indian investors make the right investment decisions during the ongoing COVID-19 outbreak. From offering valuable investment advice by CEOs of top AMCs via videos to smart interventions at key investment decision-making points on our platform, ETMONEY’s strategy to stay with the investor at every step of the journey has worked exceptionally well. Our earnest effort in handholding investors has resulted in a significant new investment on the platform. In fact, many of the categories where ETMONEY investors did well are the ones that are primarily suited for long-term wealth creation, compared to some industry inflows coming on the back of potentially not-so-sustainable returns.”

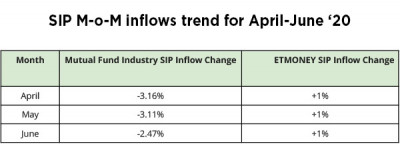

During this period, ETMONEY also witnessed growing SIP Book and reduced SIP Cancellations. The net inflow in SIPs across the entire industry has been falling month-on-month in the last three months, i.e. April, May, and June. In contrast, ETMONEY has registered a 1 percent month-on-month growth in the same period.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn