Revival & Survival: Social distancing & technology - important pillars of new normal

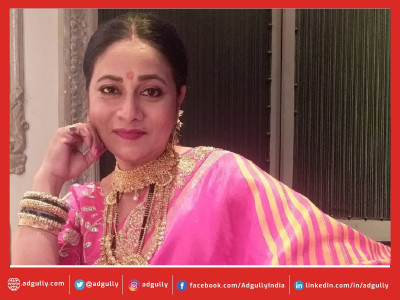

In conversation with Sapna Desai, Head of marketing and communications, ManipalCigna Health Insurance.

What does the new normal look like? How much has the COVID-19 crisis disrupted business operations?

When forecasting the future, the important aspect is to understand that time will bring about a new way of thinking, living and doing business, and this will be the ‘new normal’ for all of us. The new normal will digitally connect the team and businesses, and our approach will be based on the learnings, strategies and constraints that will help us to emerge from these uncertain times.

The COVID-19 has disrupted the economies, businesses and workplace culture. This situation has caused severe damage to economies across the world and some of the industries may take a long time to recover. It may sound strange, but this disruption also opens up a door to equip ourselves and businesses with innovation and technology. In a global crisis, it is significant to find the right solution that can help in navigating the uncertainty and prepare us to be more resilient for any similar situations, in the future.

At ManipalCigna, our robust business continuity plan enables our staff to work from home as effectively as they can in the office and ensures that our business continues seamlessly. We have also set up a cross functional committee to monitor health and safety of our employees and their families and the team is constantly monitoring and sharing the timely advisories related to health, enhanced customer experience and processes. In this new world of work, while all of us continue to perform our job responsibly, we encourage our teams to be as flexible and creative as possible.

What should be the blueprint for a post-COVID-19 economy?

As a preventive measure, we will continue to maintain social distancing in our offices after the lockdown is lifted. With social distancing and technology being the important pillars of ‘new normal’, we are working towards the guidelines and safety protocols for our partners, customers and employees.

I think it is important for businesses to draw a business continuity blueprint and strategies for the future. This will help us to be prepared for any such uncertainty and will not have adverse impact to this extent during any such crisis.

What are the 5 key measures needed to ensure a speedy business revival for the insurance industry (Life/Health)?

As companies grapple with an ongoing and evolving situation, it is important to prepare for the opportunities or challenges that may lie ahead but without losing sight of the present.

Some of the strategic measures that can help businesses to revive are:

- Adoption of technology – It is important to have online processes and other customer related demands, in order to enhance their experience. Also, digitisation will streamline the business processes and will prove to be useful in times like these. It is also time to explore and implement technologies that might already exist in other industries and apply them to ensure the long-term sustainability of an organisation.

- Crisis/ Risk Management strategy – The current crisis has been unique in the human history, but to prepare for the next unprecedented crisis, businesses will reshape their strategies for business continuity and to proactively adapt, evolve, and lead the way next time.

- Re-evaluation of business Plan – Based on the recent assessment, risk and strategy, it is important to define the right priorities while staying agile and adjusting their decisions quickly. Also, combining experience, know-how and use of communication tools, digital technologies and real-time data is a solid formula to collect meaningful insights and predictions which can be used for smooth-running operations, drive better customer experience, and to make informed decisions at any time.

- Strengthen our digital connect with customers – Nowadays, a major chunk of our young population prefers to stay connected with the brand through digital contacts, in order to find products related to their current needs. This is a unique way to instantly communicate to our stakeholders regarding newly launched products, new facilities, advisory and feedback. It also helps businesses to maintain transparency in the system.

- Up-skilling and Re-skilling the workforce – The demand for more value and competition is growing each and every day, thus to leverage and succeed in this wave, periodic new forms of training and the cycle of “Learn to do, undo, relearn and redo” must repeat many times over if one has to grow, thrive and prepare for any new level of transition.

How are you strategising for the remaining quarters of this Financial Year 2021?

In a relatively under-insured market like ours, this crisis is likely to boost demand and growth for health insurance going forward due to the looming fear of uncertainty. Thus, to help meet the strong customer growth, we have to ensure appropriate and meaningful products and services are offered to the customers basis their requirements, leverage digital and technology solutions to enhance the customer value proposition, and focus on increasing access through multi-channel distribution architecture to increase health insurance penetration and accessibility in the country.

How do you see businesses and the Government working together to undo the lockdown disruption and address the market uncertainties?

Government and businesses are taking necessary steps to share the burden of COVID-19 and easing of lockdown. The government is working towards preparing the necessary strategies and action plans not only for business continuity, but sectoral revival as well. On the other side, businesses are extending their support to overcome this crisis and support the economy through continuity of business operations, extending the support to customers and employees to help everyone overcome this financial crisis. We feel, the combined effort will soon help our economy to overcome the current situation.

How do you visualise the economy and your sector a year later? How much would it have recovered by then?

The health insurance industry has witnessed an overhaul in the past few years and due to the recent COVID-19 scenario and significant increase in awareness towards the growing cost of medical expenses, we are expecting the demand for health insurance policies to go up. Given the gravity of the current situation and the worldwide panic surrounding it, people now, more than ever before, are concerned about their health and that of their families, they’re also stressed about their finances from insurance, income, EMIs, credit card bills to taxes.

In a relatively under-insured market, the awareness is likely to boost the demand and growth for the health insurance, going forward.

At ManipalCigna, our aim is to ensure that right plan is provided to the customer basis their requirement, which can get the insured adequately covered and bring a sense of financial security against the medical expenses of the future.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn