This #MahaMarch, BankBazaar announces Positive Unit Economics

BankBazaar, world’s first multi-brand paperless platform for instant approval on financial products, launched the third edition of its annual #MahaMarch campaign – the largest-ever month-long sale of financial products in India. Along with this campaign, the company announced a major business milestone achievement of having achieved positive unit economics, i.e., the revenue it gains per transaction is higher than the marketing and operational cost for that transaction. With this news, BankBazaar joins the ranks of the very few young companies who have achieved this milestone, and establishes itself as a stable and rapidly growing young company.

During the announcement, BankBazaar also shared its growth in unique visitors. The company used to get 7 million UVs on an average until Oct 2016, which grew to 14M UVs at the close of January 2017. Approx. 56% of the traffic to the site is through the mobile website. The company also revealed an approximately 20% reduction in cost per unique visitors via paid channels for credit cards and more than 50% less spends to get unique visitors for overall loans. Personal loans contributed the most with 67% reduction in cost here. There are also plans for growth and consolidation with the hiring of approx. 400 employees especially in the Tech and Operations functions.

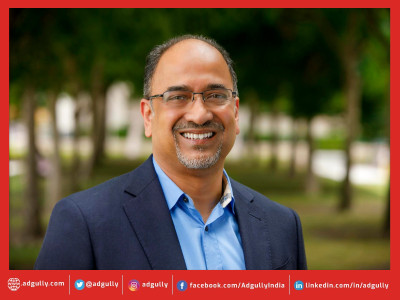

Speaking about the developments, Navin Chandani, Chief Business Development Officer (CBDO), BankBazaar, said: “This is the third year we are running the #MahaMarch campaign, and every single time, we have received great response from our partners and customers. This has inspired us to come up with better offers and exclusive schemes that make purchasing financial products more rewarding experience. While Maha March is not our only campaign of the year, it has always been the best one. And this year, Maha March is even special as we crossed the milestone of having achieved positive unit economics on every transaction. So we take this opportunity to thank our partners and customers who have trusted us and have been with us and inspired us at every step of our journey. As we end this year with a bang, we look forward to more opportunities in future to engage with our partners and make our customers’ financial journey seamless and easier.”

Maha March, one of the most unique and rightly placed campaigns for financial products, is live at the tail end of the financial year when people close the biggest financial decisions of the year – be buying a home or a car or even planning an expensive holiday. Apart from the exclusive Maha March deals on BankBazaar, customers will also receive Amazon gift vouchers on every successful disbursement of credit card and loan products applied for through the marketplace. Credit cards are eligible for Amazon Gift Card worth Rs.750. Personal loans come with Amazon Gift Card worth Rs.1000; car loans with Amazon Gift Card Rs.2500; and home loans with Amazon Gift Card worth Rs.5000. With seamless, frictionless access the right product, customized products and offers, instant, paperless purchase process, end-to-end services, and the exclusive offers during the Maha March campaign to top it all, BankBazaar makes March the best time to take that step and secure their financial journey.

BankBazaar hosts the widest range of financial products from over 75+ of the biggest public and private sector banks, NBFCs, and insurance companies in India. It gets an average of 7,000,000 visitors per month. The company raised USD 80M through funding from investors such as Amazon.com, Fidelity Growth Partners, Mousse Partners, Sequoia Capital and Walden International.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn