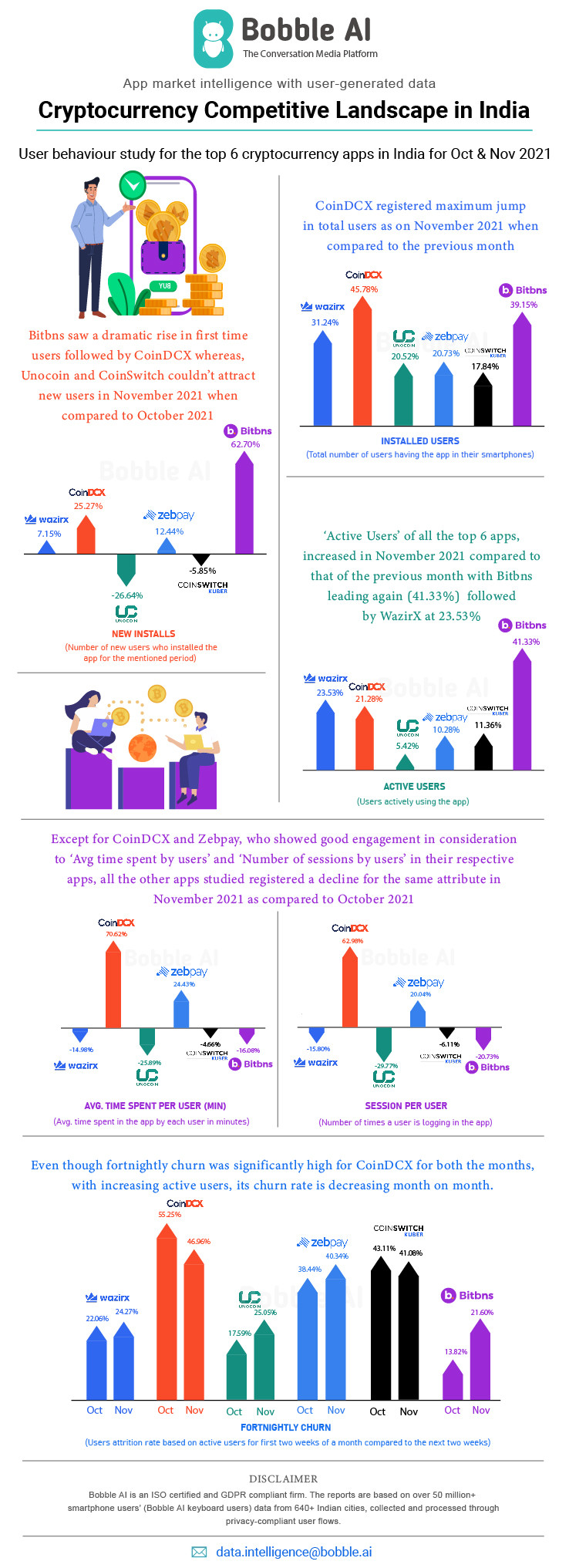

CoinDCX registers 45.78% growth amid ongoing uproar – Bobble AI Report

Amid the buzz around the impending Cryptocurrency Bill to address unregulated cryptocurrency use in India, industry player CoinDCX has not just witnessed a 45.78% spike in installed users between October and November 2021 but also noticed the churn rate reducing month on month. At the same time, Bitbns leads in terms of active users at 41.33%.

These findings stem from a recent analysis of user behaviour among India’s top 6 cryptocurrency apps, including WazirX, CoinDCX, CoinSwitch, ZebPay, Unocoin & Bitbns, between October and November 2021. The study was conducted in a privacy-compliant manner by the data intelligence division at Bobble AI, India’s largest conversation media platform, covering its vast base of 50M+ users.

Here’s a closer look at the data:

Amid the uproar around the crypto bill which will convey the Indian government’s stance on crypto, all the top cryptocurrency apps studied have shown promising results in terms of total installed users, with CoinDCX leading the pack with a 45.78% spike in total installed users in November 2021 compared to October 2021. The finding goes to show that the impending decision is not affecting crypto enthusiasts in India.

The number of ‘New Installs’ compared for the same duration took a hit for Unocoin and CoinSwitch, but Bitbns was able to register a 62.70% rise for the same attribute, followed by CoinDCX, ZebPay, and then WazirX. This hit could be temporary and partly be attributed to the news of the Indian government hinting to introduce the Cryptocurrency bill 2021 to regulate digital currencies.

Until recently, only a handful of individuals were investing in digital currencies, but with more market awareness coupled with increased marketing spending, there has been a surge in cryptocurrency adoption by Indians. The increasing number of cryptocurrency adopters reflects a transition in the investing paradigm, spurred primarily by the country’s younger generation, which is welcoming a shift in investment from real estate and gold to cryptocurrencies.

Another sound reason for the enthusiasm for Cryptocurrency adoption is the technological advancement that welcomes us into a new era of payments and other financial services that are cheaper, faster, and more accessible. This is validated by Bobble AI’s finding that noticed the number of ‘Active Users’ of all the top 6 apps, increasing in November 2021 compared to that of the previous month with Bitbns leading with 41.33% rise followed by WazirX at 23.53%.

While it’s established by studying the user behavior that digital currencies are here to stay, it is vital to note that user engagement within these apps is still a cause of concern. Except for CoinDCX and ZebPay, who showed good engagement in consideration to ‘Avg time spent by users’ and ‘Number of sessions by users’ in their respective apps, all the other apps studied registered a decline for the same attribute in November 2021 as compared to October 2021.

One of the most important KPIs for any app is the ‘Churn rate.’ It is the percentage of lost customers over a period. So, it becomes imperative to keep a check on it. According to Bobble AI’s data Intelligence, Fortnightly churn (calculated based on number of active users, in first two weeks vs the next two weeks of October and November respectively) was significantly high for CoinDCX but with increasing Active Users, its Churn Rate is decreasing month on month. Whereas Bitbns saw maximum rise in active users’ attrition, even though they registered huge jump in active users in November as compared to October.

Rapid adoption and expansion of digital currencies in India look promising. Bobble AI’s findings reveal that India is ready for this technological revolution and is poised to grow tremendously in the coming years.

Bobble AI report is based on over 50 million smartphone users’ (Bobble keyboard users), data from 640+ Indian cities, processed in a privacy-compliant manner.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn