Online shoppers in India to reach 175 mn by 2020: Google-AT Kearney report

Capturing the evolving industry dynamics and key consumer insights that will drive the next phase of e-commerce, Google and AT Kearney have released a report, titled ‘Digital Retail 2020’. The report, that combines insights from a comprehensive market research with AT Kearney’s market model, projects that e-tailing will become a substantial channel for the organised retail sector, contributing as much as 25 per cent of the total organised retail sales in by 2020 and will reach $60 billion in gross merchandising value.

The report predicts that the total number of online shoppers will grow to 175 million by 2020 and one-third of customers will drive two-third of total online shopping spends. As per the report, value added service will be a key differentiator and over 90 per cent of the online buyers will be willing to pay for premium value added services – over 46 per cent of online buyers said that they will be willing to pay extra charges for faster delivery; 37 per cent for hassle free return and 35 per cent were willing to pay more for extended warranty.

Speaking about the key findings of the report, Rajan Anandan, VP & Managing Director, Google SEA & India, said, “The e-tailing industry in India is at an inflection point and will touch 175 million online buyers by 2020. Having said that, the next three to four years will be critical for the industry to get on the path of sustained profitability. As per the report, some of the areas that will accelerate and support profitability include following a focussed approach to drive deeper engagement with 60 million high value customers as they will drive two-third of the total spends on e-tailing. Innovative delivery models and creating omni channel presence will help bring on board new online shoppers and help grow the overall share of e-tailing from the organised retail Industry in India.”

Ajay Gupta, Partner with AT Kearney, highlighted, “As the Internet continues to grow, digital presence is paramount for brands and organised retail. It will influence 50 per cent of all purchase decisions, be it in discovery or comparison. Our data reveals that majority of buyers will continue to purchase online even if there are no discounts. With the right game plan and focussed efforts the e-Tailing industry will grow at a healthy CAGR of 40%+.”

Some of the other findings of the report include a 5X growth in number of women shoppers by 2020 and women currently shopping online will more than double their share of online spend. They are likely to spend more on lifestyle categories, namely apparel and accessories, and are looking for the latest trends and brands online. Women respondents also said that they would increase their spends of online shopping if they could get more options for flexible delivery time, and more pick up locations so that they don’t have to divulge too many personal details.

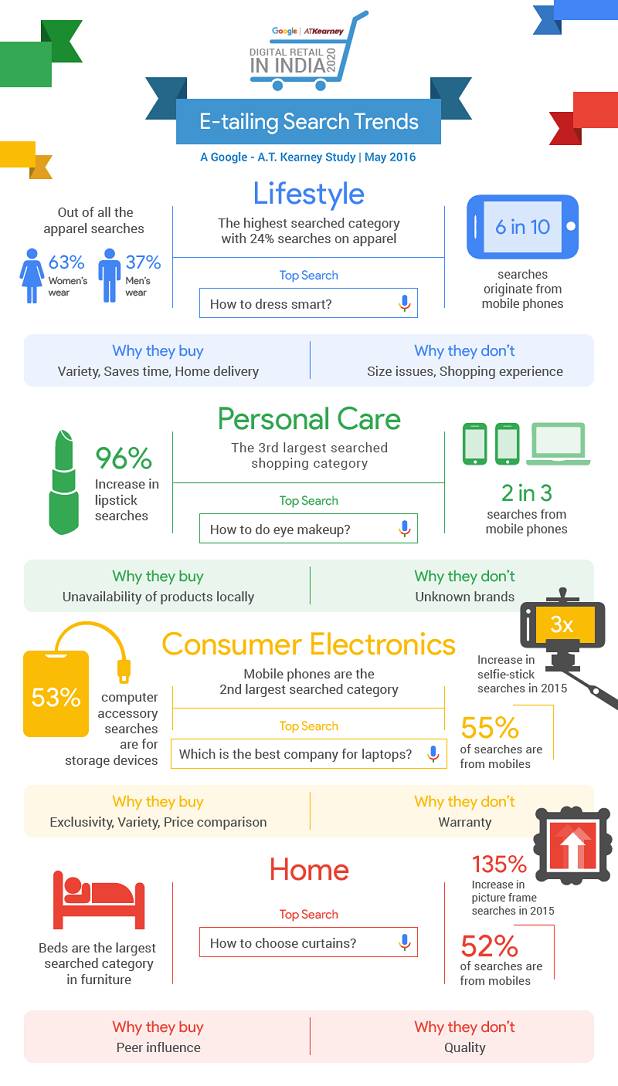

Growth of Lifestyle category

Lifestyle (apparels and accessories) as a category will overtake consumer electronics to become the largest online category by 2020 at 35 per cent of the total online spends. Consumer electronics will be at 20 per cent by 2020. New buyers will more likely start their online purchase journey with Lifestyle, followed by Consumer Electronics and existing buyers will spend more on Lifestyle driven by availability of latest designs. Niche categories like home (furniture and furnishing) and personal care will see high adoption due to assortment and convenience of purchase especially in Tier 2+ cities.

Omni-channel presence will become very important in Home & Furnishings, Lifestyle and Consumer Electronics category to serve the need-gaps of non-buyers. In home and furnishing, over 60 per cent buyers wanted physical stores to be able to see and test the product before buying. In lifestyle, 40 per cent respondents said that offline stories will help in alterations of clothes and for consumer durables 60 per cent buyers wanted salesman guidance for installing and using the product.

By 2020, 55 per cent of online volumes will be driven by cashless transactions (as opposed to ~40 per cent today). Mobile wallet share will double by 2020 to reach 15 per cent from current 8 per cent. The base of online sellers will need to grow by 5X+ to cater to the increase in demand from users across geographies and improve delivery capabilities.

Report methodology

The report was compiled by combining primary research of over 3,000 consumers, qualitative interactions of 60-plus consumers and AT Kearney’s proprietary model predicting e-commerce spend across categories, income segments, and geographies in 2020. Respondents comprised online buyers (1,380) and non-buyers (1,380), sellers, non-Internet users across 20 cities in India, including metros and Tier 1, 2 and 3 cities.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn