Unveiling Insights: Chrome Subscriber Establishment Survey for July 2023

The world of media and entertainment is in a constant state of flux, with trends, technologies, and consumer preferences evolving at a rapid pace. In this dynamic landscape, staying attuned to the latest shifts in subscriber behavior and platform preferences is crucial for industry players. Enter the Chrome Subscriber Establishment Survey for July 2023, a comprehensive study that delves into the changing dynamics of the broadcasting industry.

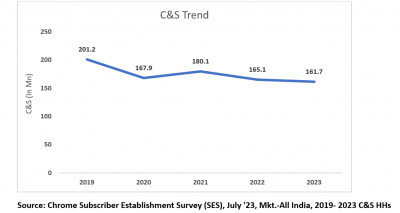

The new findings from July report of Subscriber Establishment Survey (SES) put out by Chrome Data Analytics and Media capped off a significant drop in Cable and Satellite (C&S) homes where the subscriber base has seen a substantial drop from 201.2 million to 161.7 million households since 2019.

This is based on a Pan India ground survey conducted between January’ 23 to July’ 23; representing over 227 million TV households & 161.7 million C&S TV households in the country.

The survey is a periodic study conducted by Chrome DM that plays a fundamental role in shaping the understanding of a changing TV landscape. Commenting on these revelations, Pankaj Krishna, the Founder and CEO of Chrome DM, remarked, "We are witnessing a significant shift towards entertainment through OTT platforms, positioning them as the frontrunners. I anticipate this trend will persist until 'streaming' becomes firmly established as the prominent choice during this period of transformation."

According to the CHROME DM SES July 2023 report, the landscape of TV distribution platforms reveals that Digital cable holds the largest portion, constituting 37.6% of the total market share. Pay DTH (Direct-to-Home) services closely trail behind, accounting for 34.51% of the overall share. However, the report indicates contrasting trajectories for these platforms.

|

TRANSMISSION |

C&S Share |

|

DIGITAL |

37.60% |

|

PAY DTH |

34.51% |

|

FREEDISH |

27.89% |

|

Source: Chrome Subscriber Establishment Survey (SES), Mkt, - All India, July '2023, 161.7 Mn |

|

Pay DTH witnessed a substantial decline of 11%, while Digital cable experienced a more moderate dip of 2.7%. Conversely, FreeDish demonstrated noteworthy growth, registering an impressive gain of 10.8%. These shifts reflect the dynamic nature of the television distribution ecosystem, prompting industry players to adapt and strategize accordingly.

|

STATE |

GAIN% |

||

|

DIGITAL |

-2.7% |

||

|

DTH |

-11.0% |

||

|

FREEDISH |

10.8% |

||

|

Source: Chrome Subscriber Establishment Survey (SES), July '22 Vs July '2023 |

|||

The Digital Cable segment witnessed an interesting juxtaposition of gains and losses across rural and urban markets. In rural areas, there was a noticeable decline of 7.3%, indicating a shift in viewer preferences or perhaps increased competition from alternative platforms. On the contrary, the urban market experienced a slight uptick of 0.9%, suggesting a continued relevance of Digital Cable among urban subscribers.

The DTH sector, which has been a popular choice for television consumers for years, faced a more pronounced decline. In the rural market, DTH recorded a significant loss of 13.6%, raising questions about the factors contributing to this drop. Similarly, the urban market saw a decrease of 8.6% in DTH subscribers. This trend sparks discussions about the evolving preferences of viewers in the face of new and emerging technologies.

Amidst these shifts, FreeDish emerged as a notable contender. With a remarkable gain of 10.9% in the rural market, it showcased its appeal among rural viewers. Even in urban areas, FreeDish secured a solid gain of 7.1%. This positive trajectory highlights the platform's growing significance and its ability to attract a wider audience.

|

Transmission |

Rural |

Urban |

|

DIGITAL |

-7.3% |

0.9% |

|

DTH |

-13.6% |

-8.6% |

|

FREEDISH |

10.9% |

7.1% |

|

Source: Chrome Subscriber Establishment Survey (SES), July '22 Vs July '2023 |

||

AP Fibernet experienced a significant surge of 61.6%, closely trailed by HITS with a robust increase of 41.9%. Notably, Den, Rajasthan Infotech, and Darsh also demonstrated impressive gains, registering growth percentages of 23.8%, 22.8%, and 19.9% respectively.

|

DTH/MSO |

GAIN% |

||||||

|

AP FIBERNET |

61.6% |

||||||

|

HITS |

41.9% |

||||||

|

DEN |

23.8% |

||||||

|

RAJASTHAN INFOTECH |

22.8% |

||||||

|

DARSH |

19.9% |

||||||

|

Source: Chrome Subscriber Establishment Survey (SES), Mkt.-All India 161.8 Mn, (July '23) Vs 165.1 Mn, (July '2022) |

|

||||||

Strata observed fluctuations across different regions:

- In HSM, there was a gain of 0.9% in the rural market, but a loss of 3.2% in the urban market.

- In the South region, there was a loss of 9.5% in the rural market and a loss of 3.8% in the urban market.

- Across All India, there was a loss of 1.9% in the rural market and a loss of 3.5% in the urban market.

|

STRATA |

RURAL |

URBAN |

|

HSM |

0.9% |

-3.2% |

|

SOUTH |

-9.5% |

-3.8% |

|

ALL INDIA |

-1.9% |

-3.5% |

|

Source: Chrome Subscriber Establishment Survey (SES), Mkt, - All India, July '2023, 161.7 Mn |

||

The waning attraction towards conventional linear television has resulted in a steady decline in cable and satellite subscriptions. Concurrently, the upward trajectory of streaming consumption appears increasingly unavoidable. Prominent platforms such as Netflix, MX Player, Disney+ Hotstar, Jio Cinema, etc. provide extensive content repositories.

This continues to be an appealing choice for numerous cord-cutters who are hesitant to allocate additional funds for cable or digital subscriptions, which have historically been integral components of standard television setups.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn