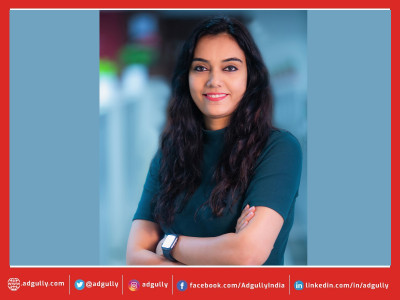

Sharpening Business Continuity Plan is new normal for insurance sector: Shefali Khalsa

In conversation with Adgully, Shefali Khalsa, Head – Brand & Corporate Communication, SBI General Insurance, speaks about how the insurance sector is operating amid the COVID-19 crisis and the long-term implications for this sector as well as the economy.

What are the long-term implications of COVID-19 for the medical insurance industry?

COVID-19 has certainly increased the awareness about the requirement for health insurance amongst the general public. The efforts made by the insurance regulator in introducing a standardised health insurance product, Arogya Sanjeevani, have also helped in increasing this awareness. In the long term, we can expect insurance companies to come up with pandemic/ epidemic specific health insurance products to take care of the requirements in this segment.

What kind of increase are you expecting to see, especially in medical insurance costs?

So far, we in India appear to have done a good job in terms of containing the spread of COVID-19 and as on date the number of health insurance claims reported are on the lower side. However, it would be premature to comment on the possible impact of medical insurance costs at this stage.

Would Force Majeure clauses apply in case of claims for COVID-19 victims?

There are no specific exclusions relating to pandemics/ epidemics like COVID-19 in health insurance policies and hence, Force Majeure clause would not apply.

Apart from the growing number of casualties due to COVID-19, what other risks is the insurance industry faced with – ranging from litigation to insolvency?

The insurance industry would have to cope with the challenge of a possible downturn in the economy due to COVID-19, which would have a direct impact on the premiums. Moving forward, the industry would have to look at introducing new products catering to the requirements of epidemics/ pandemics.

What strategy has SBI General Insurance put in place to navigate through the ongoing crisis?

At SBI General, People First and Customer-Centricity are at the core of everything that we do. Amongst all other stakeholders, they continue to be at the center of our robust Business Continuity Plan (BCP) as well.

We are following a comprehensive BCP to address all probable situations and attune to near-to-normal BAU using virtual and digital modes. We are taking care of our employees’ health and safety and at the same time ensuring that we deliver on our commitment to our customers. Thus, even during the current crisis, we are committed to offer the best of services to our customers. At the very early stage of COVID-19 outbreak, we had formed the Emergency Management Team (EMT) that comprised of the core leadership group.

We have been closely monitoring the situation in liaison with the all Government authorities and accordingly, all necessary advisory is being issued to the employees and other stakeholders. EMT has been taking necessary steps as per our crisis management plan, to reshape the business strategy suiting the evolving situation; and to maintain business continuity, to build resilience and prepare for recovery.

We also have a Crisis Management & Communication Plan for COVID-19 in place. In the plan, we have highlighted the necessary Do’s and Don’ts for the stakeholders.

To make the Work From Home a pleasant and productive experience for the employees, the EMT has provisioned for various L&D interventions, engagement activities and monitoring matrices.

Are you doing any sustenance advertising to keep your brand top of mind? If yes, what is your media mix?

The current situation is a bit unfortunate and hence, the sentiments are not relevant for brands to advertise or push products. However, the most important communication for us currently is to stay connected with our customers and channel partners, hence, we are active on our social media platforms. And constantly communicating with our channel partners via WhatsApp business account and emails.

What new normal do you see emerging in the post-COVID-19 world – (a) for the overall economy; and (b) for the insurance sector?

(a) In every economy, the new normal would be something wherein the focus would shift on healthcare sector. The investments and plans to enhance the medical equipments, and researches will gain momentum.

“Digital” will be the other ‘new normal’ as everyone is citing this as new normal even now. The focus will move towards digital payments, trades, more focus on technologies, which will enable people to maintain social distance.

“Social Distancing” will also emerge as the ‘new normal’. Companies will keep themselves prepared for similar unforeseen events.

Online apps and tools supporting Work From Home will be another ‘normal’ for the economy.

(b) For the insurance sector, the new normal largely would be sharpening the BCP to keep #BAUUninterrupted and strengthening the digital platforms enabling spike in online sales.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn