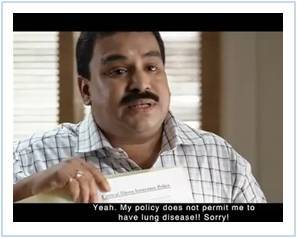

Bharti AXA GI new campaign, an eye opener

The creative for this campaign was done by Grey. An official from Grey commented on the objectives, "'Critical Illnesses do not look at insurance policies before striking' with this key insight in mind, we launched our nationwide ad campaign. The objectives of the campaign are to create preference for Bharti AXA GI that's "disruptive" (breaking norms/inertia to buy)."

This campaign moves away from the common imagery used in Health ads of suffering patients wheeled into intensive care and instead it refreshingly uses humour to underscore the fact that it is important to have a comprehensive insurance policy. The campaign looks at creating dissonance in the minds of consumers about the inadequacies that can exist with their existing Insurance policy and advocates the fact that Bharti AXA's Smart health Critical illness policy covers the highest number of illnesses in India.

Bharti AXA General Insurance's primary focus is their health insurance products out of which their prime product is the Critical Illness product. This critical illness product covers 20 critical illnesses as against 14 illnesses covered by other general insurance companies. The policy not only cover basic illnesses but also cover other critical ailments like Cancer, first heart attack, Heart valve surgery, Coma, organ transplantation, kidney failure with lump sum compensation.

Bharti AXA is the only company with a critical illness product which covers 20 illnesses.

The Grey official further said, "The response has been very positive; we have been getting queries from across cities asking for more details about the product. We have received over 15000 responses in just 20 days, fairly high for our category. The fact that one does not read through their insurance policies is very true, considering the response we are getting even from existing health insurance users in the category."

He further added, "This advertisement is proving to be an eye opener to those people who ignore the fact that a health insurance policy is a must-have in the present day lifestyle and that health insurance partner should be someone who can help you protect your wealth, protect your income and protect your livelihood."

It is a TV and outdoor led campaign. | By Janees Antoo [janees(at)adgully.com]

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn